301 Moved Permanently

In order to find success and stay competitive, a company often must work to balance and address a host of considerations, such as pricing, quality, innovation and distribution. The same is very true for rooftop racking and mounting system providers, all of which are vying to become an even larger part of a growing solar industry.

Andrew Barron Worden, CEO of GameChange Solar, says the pressure is on to offer lower-cost mounting products.

“In the earlier days, back when solar panels were much more expensive, no one really cared about the pricing for racking,” he states. “But now that panels are much cheaper, everyone is paying closer attention to the overall price of a project and demanding cheaper racking.”

Aaron Faust, vice president of business development at Applied Energy Technologies (AET), says, “Pricing issues exist now more than ever due to the amount of competition in the industry and the tight budgets on each individual project.”

According to Worden, Faust and representatives from other racking and mounting companies, material costs certainly play a role in their end products’ pricing. Aluminum and steel are typically key raw materials used in mounting and racking systems, and the good news is that the prices of those materials have recently gone down.

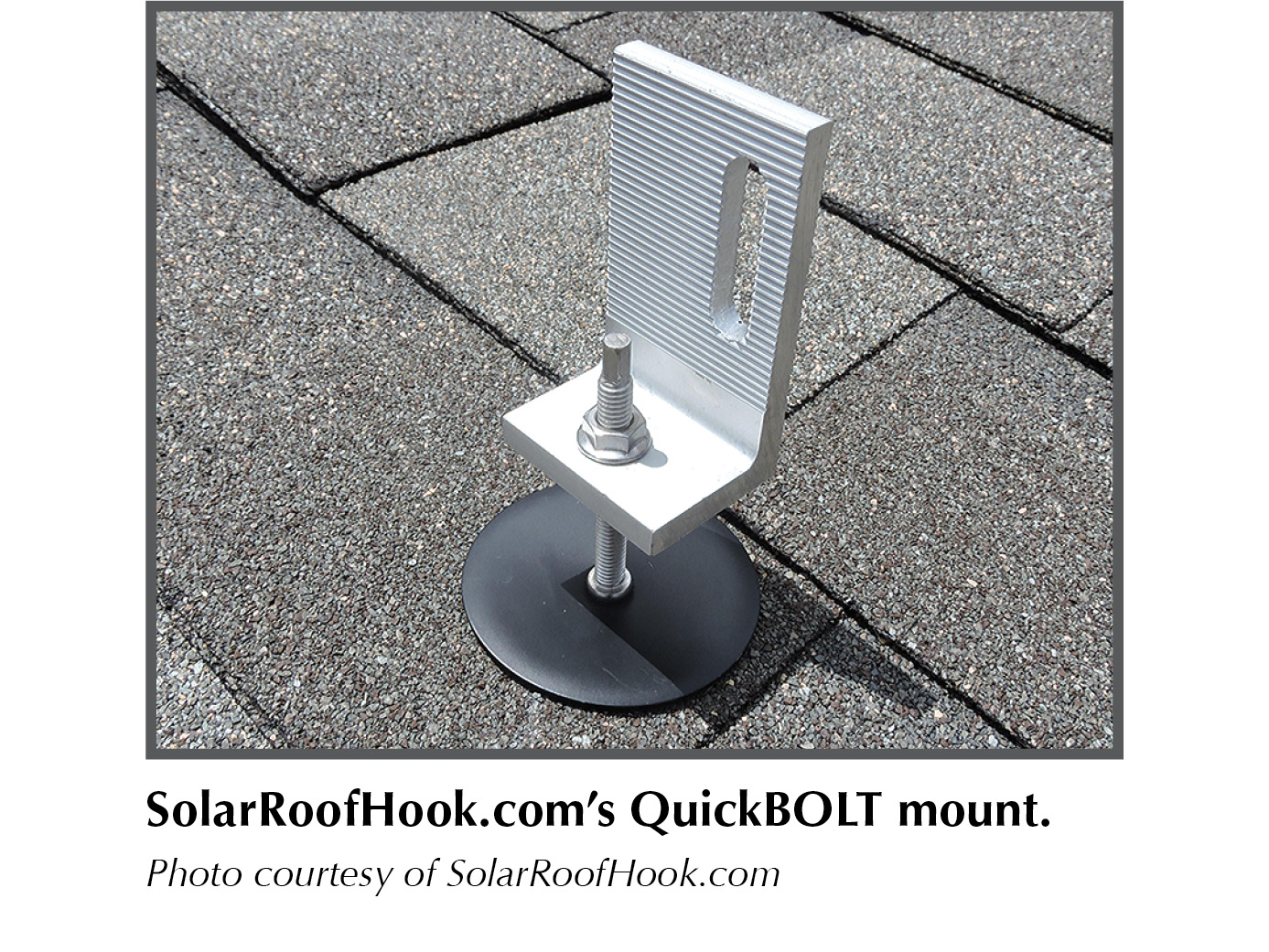

Faust says raw material costs “were quite volatile” between 2006 and 2010. However, as Rick Gentry, vice president of sales at SolarRoofHook.com, explains, pricing has become “relatively stable” over the past five years, with decreases during the past year or two.

“Raw materials’ pricing tends to follow commodity market trends. While aluminum is relatively low, steel is at near-historic lows,” says Jason Whitaker, chief technology officer at Shoals Technologies Group. “In a mature commodity market, that would have had a big impact, but solar is anything but traditional. The solar industry has been doubling capacity every year. Consequently, the pricing has been dropping.”

Notably, he adds, “This drop in price has been driven by high demand and engineering optimization more so than raw material pricing.”

GameChange’s Worden concurs, saying, “Most of the price reductions have resulted from better engineering and tighter margins. Nonetheless, a sizable part of them has come from lower material prices, which account for maybe 20 to 30 percent of the reductions.”

Some engineering solutions could include reducing redundancies and offering systems that are easier and faster to install.

For example, Jeremy Shanker, head of marketing and design at Solar Mounting Solutions (SMS), says, “Our racks are pre-assembled, therefore requiring fewer man-hours to install and reducing costs to our customers.”

Worden also suggests that the racking and mounting industry has started to shift away from using aluminum and is increasingly turning to steel: “Basically, steel has gotten so cheap now that pretty much everyone has gotten out of aluminum for racks.” He adds that aluminum flexes and expands more than steel. “Flex is a big issue. Everything can move around,” he explains. “Aluminum expands back and forth a lot, but steel expands and contracts very little.”

His company uses mostly galvanized steel for its rooftop products, but GameChange does offer aluminum systems. According to Worden, “Aluminum still has its benefits.” He says aluminum systems can be optimal for some applications, such as metal roofs, which “aren’t nearly as popular in the U.S. as they are elsewhere.”

“Cost is the biggest driver in mounting design right now,” says AET’s Faust. “We have moved away from aluminum and stainless steel to mostly galvanized steel.”

Looking ahead, Shoals’ Whitaker says, “We believe raw materials will have an impact from 2017 on, when solar will start to behave like a more traditional commodity.”

“Recently, [the price decrease for materials] has surely helped, although it does present a risk on future projects if it begins to trend back up,” cautions Faust.

Worden says the potential impact of price increases for raw materials depends on just how steep the rise is. “If steel goes up five or 10 percent, our prices would probably still stay down,” he predicts. “If steel goes up 20 to 30, our prices would probably go up just a tiny bit. But if steel goes up 50 percent, our prices would likely go up quite a bit.”

Regardless, each company agrees that providing a quality product is most important.

To the roof

Another essential link in the racking and mounting companies’ supply chain is, of course, distribution - how to get their products to customers. Those customers can vary from large energy companies and big-name installers to small, local firms.

“Generally, our products ship directly to the job site,” says Whitaker. “Shoals is a global company, and as a result, we offer a multitude of options for transporting our goods, all directly dependent upon the particular project needs. We also work with our customer(s) to offer multiple delivery options: ExWorks, FOB, CIF and DAP, just to name a few.”

“We have refined some of our kitting processes to allow products to ship more efficiently,” says SolarRoofHook.com’s Gentry. “This new process has drastically decreased our lead times. The customer has the option to choose between shipping UPS, one of our partner trucking companies or will-call pickup direct from our warehouses.” SolarRoofHook.com has warehouses in Livermore, Calif., and Rock Hill, S.C.

“Most of the product we sell is shipped directly to the job site via [less than truckload] of full trailer/flatbeds,” explains Faust. He adds that AET also has distributors that stock products for local deliveries.

Shanker says SMS ships directly to job sites, as well. “We have our own fleet of trucks, although we use other various shipping methods when required. We can warehouse and ship direct for customers, saving them money,” he says. SMS has a 125,000 square-foot warehouse and manufacturing facility in Newburgh, N.Y.

Although GameChange relies on third-party trucking companies to get its products to customers, Worden notes his firm has “been playing with the idea of using rail.” However, “It hasn’t really penciled out.”

“Relying on rail in this industry, with the turnaround times we have to deal with, is just not practical,” he says. “Rail represents a cheaper alternative, but it takes long. In theory, in a perfect world, you’d have a few weeks to deliver stuff and could deliver big chunks of product. But customers don’t need your product one day and then, all of a sudden, they need it tomorrow.”

Whitaker agrees that “the nature of the solar industry” can cause logistics problems. “This is a ‘hurry up!’ and ‘wait!’ type of industry. So, for the control freak expecting steady forecasts and linear trends, this is probably not the best place to be, as solar is a roller coaster of an industry. Shoals has learned how to ride this roller coaster very well over the years.”

“Logistics are always a challenge in that shipping can add up,” says Faust. “We need to pack and load as efficiently as possible on each project. We also have to work with our customers to make sure transit times and delivery windows line up between the shipment and the site.”

Another potential problem is product availability.

“Product availability is only an issue when a customer is not able to plan appropriately,” says Faust. “AET holds a reasonable amount of stock at its plant and with its distribution partners.”

“The best we can do as suppliers is look to the past and keep stock levels based on historical data,” says SolarRoofHook.com’s Gentry. “This can be very difficult when usage fluctuates constantly based on different factors throughout the year. The more transparent customers are, the better we can predict usage and therefore maintain more optimal stock levels.”

According to the racking and mounting providers, the solar industry can rest assured that they are working to ensure their products are reasonably priced and well made, as well as doing their best to get those products to job sites and atop roofs on time.

Rooftop Racking & Mounting

From Factory To Roof: A Look At Mounting Makers’ Supply Chains

By Joseph Bebon

Rooftop racking and mounting system companies discuss material costs and logistics.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph