301 Moved Permanently

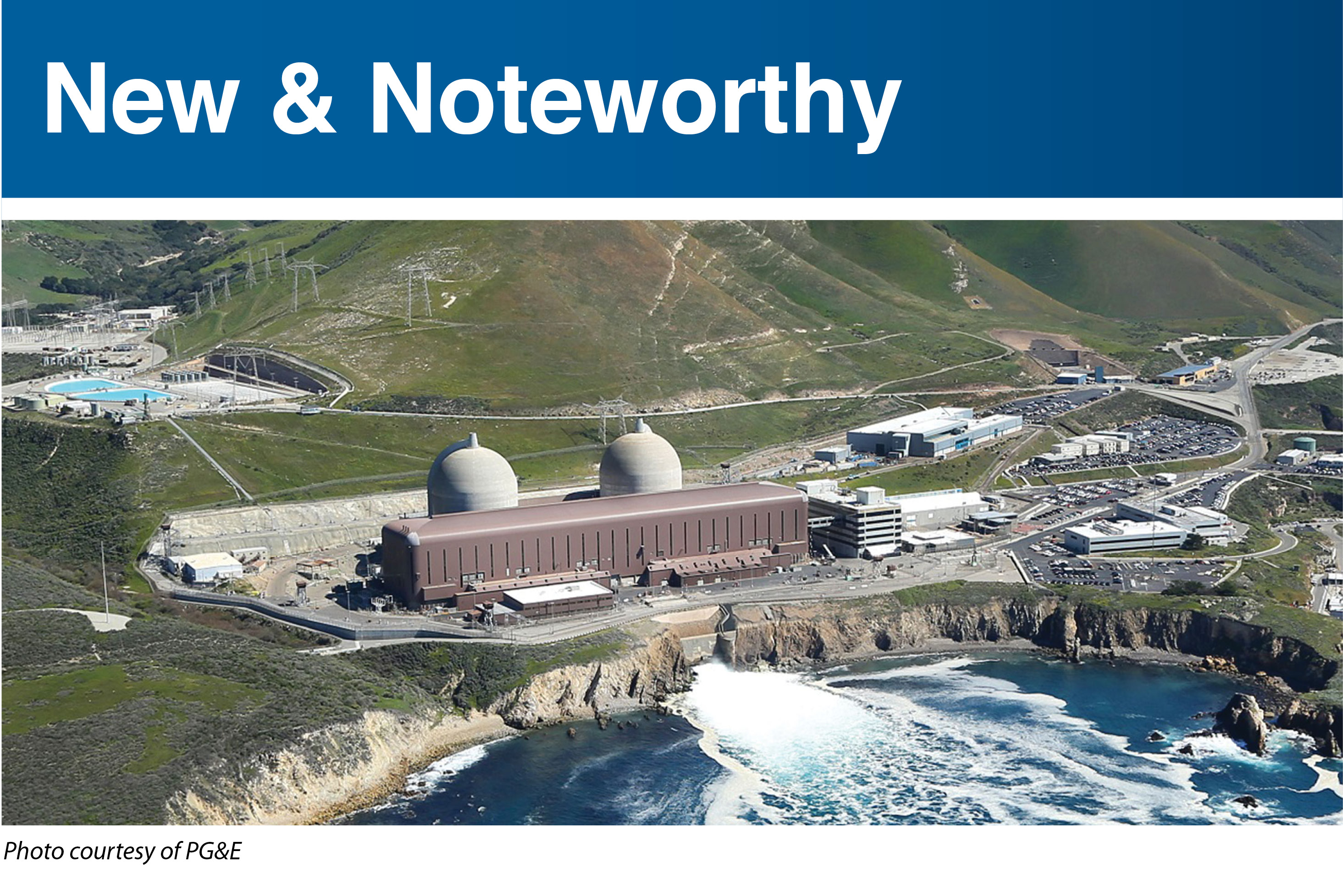

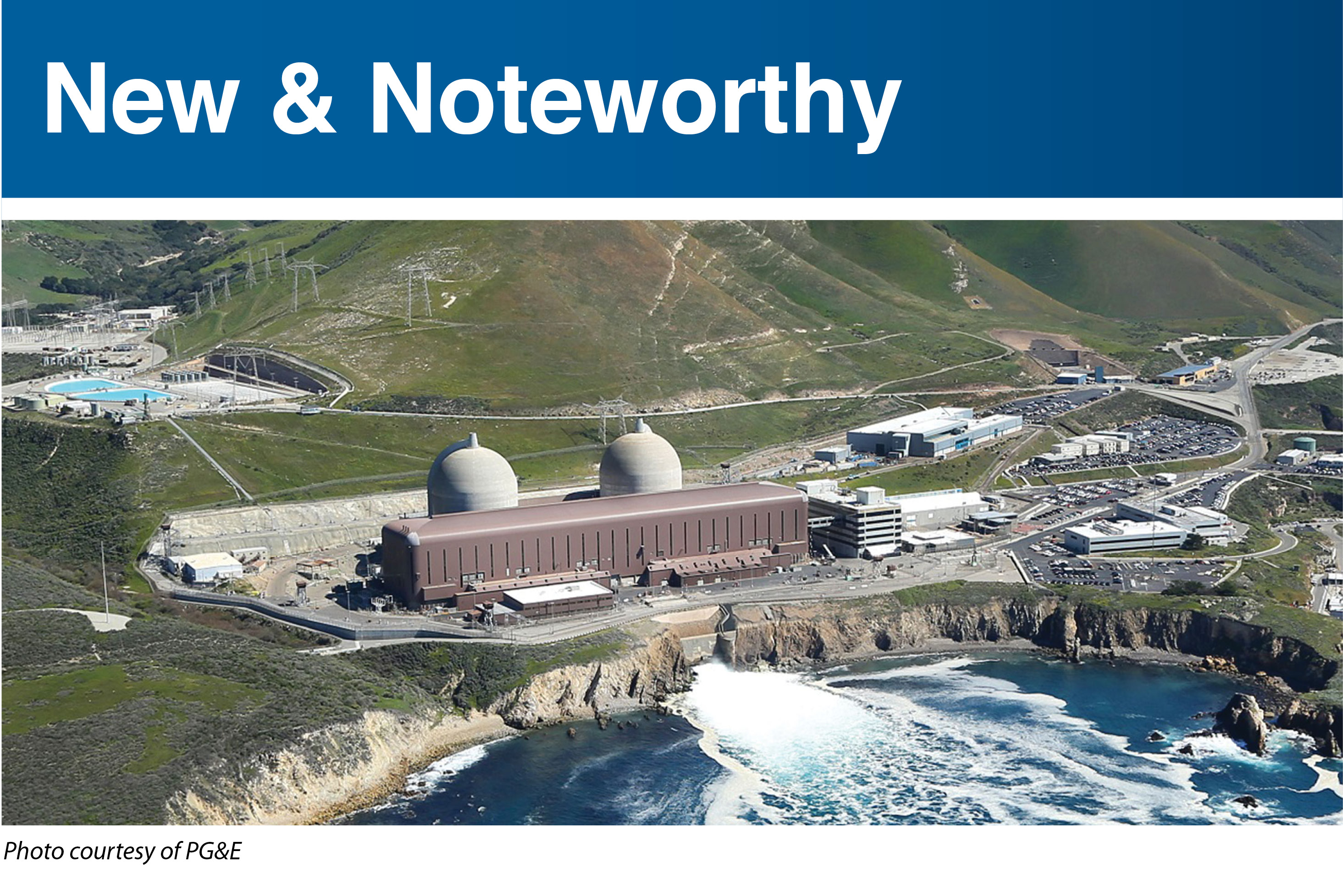

PG&E Plans To Shutter State’s Last Nuclear Plant

Pacific Gas & Electric (PG&E) has announced a joint proposal with labor and environmental organizations to phase out California’s last remaining nuclear power plant and replace the facility’s energy production with a portfolio of energy efficiency, renewables and storage by 2025.

Underpinning the agreement is the recognition that new state energy policies will significantly reduce the need for the electricity output from the two nuclear reactors at the Diablo Canyon Power Plant (DCPP). Such policies include S.B.350, which increased California’s renewable portfolio standard (RPS) to 50% by 2030 and doubled energy-efficiency goals. The joint proposal would include a PG&E commitment to go beyond the state RPS and set a 55% by 2030 renewable energy target.

The parties to the joint proposal include PG&E, the International Brotherhood of Electrical Workers Local 1245, the Coalition of California Utility Employees, Friends of the Earth, the Natural Resources Defense Council (NRDC), Environment California and the Alliance for Nuclear Responsibility.

Under the terms of the proposal, PG&E would retire the DCPP at the expiration of its current Nuclear Regulatory Commission operating licenses, which are due to lapse on Nov. 2, 2024, for the Unit 1 reactor and Aug. 26, 2025, for Unit 2. The utility has agreed to not seek renewal of the licenses, and this eight- to nine-year transition period is expected to provide the time necessary to plan and replace Diablo Canyon’s energy with new greenhouse gas (GHG)-free resources.

Furthermore, the parties to the agreement say they are jointly committed to supporting a successful transition for DCPP employees and the community.

“California’s energy landscape is changing dramatically, with energy efficiency, renewables and storage being central to the state’s energy policy. As we make this transition, Diablo Canyon’s full output will no longer be required,” explains PG&E CEO and President Tony Earley. “Importantly, this proposal recognizes the value of GHG-free nuclear power as an important bridge strategy to help ensure that power remains affordable and reliable and that we do not increase the use of fossil fuels while supporting California’s vision for the future.”

He adds, “Supporting this is a coalition of labor and environmental partners with some diverse points of view. We came to this agreement with some different perspectives - and we continue to have some different perspectives - but the important thing is that we ultimately got to a shared point of view about the most appropriate and responsible path forward with respect to Diablo Canyon and how best to support the state’s energy vision.”

In a separate press release, NRDC says it estimates PG&E customers will save at least $1 billion from the agreement’s implementation.

“Energy efficiency and clean renewable energy from the wind and sun can replace aging nuclear plants - and this proves it. The key is taking the time to plan,” comments NRDC President Rhea Suh. “Nuclear power versus fossil fuels is a false choice based on yesterday’s options.”

Erich Pica, president of Friends of the Earth, calls the agreement “historic” and says, “It sets a date for the certain end of nuclear power in California.”

At press time, the joint proposal is contingent on a number of state regulatory approvals.

Regulators Reverse Denial Of Xcel’s Solar Settlement

The Colorado Public Utilities Commission (CPUC) has unanimously approved a proposed settlement agreement between Xcel Energy and three community solar companies after reconsidering the deal.

In February, Xcel announced a compromise with Clean Energy Collective, Community Energy Inc. and SunShare under which the utility agreed, among other things, to procure up to 60 MW of new community solar garden (CSG) capacity in Colorado through its Solar*Rewards Community program this year.

As reported in Solar Industry’s May 2016 issue, the CPUC rejected the agreement in March, claiming the proposal lacked sufficient details to support approval. In a press release, the CPUC says that new testimony and additional financial and legal evidence presented at a June 1 rehearing adequately demonstrated that the proposed agreement was in the public interest.

The CPUC says the agreement will spread the benefits of CSGs among as many customers as possible, including low-income and other individuals and businesses that want to promote solar energy. Among the issues resolved by the rehearing were questions about the $0.03/kWh renewable energy credit price and the method for determining customer bill credits for CSGs.

Alice Jackson, Xcel Energy’s regional vice president of rates and regulatory affairs, has welcomed the new decision. However, Jackson notes that as of press time, the details of the approval are still unclear until the written order is issued.

“The Colorado Public Utilities Commission’s approval of the settlement is reflective of Xcel Energy’s dedication to always delivering what our customers want - more energy choices,” says Jackson. “The collaborative approach with the parties is appreciated and is important to our energy future in Colorado.”

Clean Energy Collective says the aim of the settlement agreement was to address elements of Xcel’s program that had the unintended consequence of prioritizing only certain types of commercial customers.

Now that the CPUC has approved the settlement, Paul Spencer, Clean Energy Collective founder and CEO, states, “We appreciate the commission’s efforts addressing this important issue and are pleased with their decision. The broad support from political leaders, Xcel Energy, conservation organizations and others is why Colorado is a leader in community solar and will continue to have a vibrant, healthy industry.”

For its part, Clean Energy Collective says it will immediately carry on developing 12 MW of capacity awarded in its 2015 allocation from the utility and will bid for additional Xcel projects allowed by this decision.

Sungevity To Go Public Through Reverse Merger

Rooftop solar provider Sungevity Inc. says it will become a public company through a reverse merger with Easterly Acquisition Corp., a blank-check company that is already public.

In a press release, the two companies say that under their definitive agreement, all of the outstanding equity and convertible debt of Sungevity will be converted into shares of Easterly common stock. Once the deal is closed, Easterly will change its name to Sungevity Holdings Inc. and will trade on the NASDAQ stock exchange under the ticker symbol SGVT. According to a Reuters report, the agreement is worth approximately $357 million.

Sungevity’s management team will remain with Sungevity Holdings under the leadership of current Sungevity CEO and Co-Founder Andrew Birch. Sungevity Holdings’ board of directors will consist of members from the current boards of both Easterly and Sungevity.

“We have always considered ourselves to be the ‘disruptor’ within a disruptive industry,” says Birch. “Easterly’s management has a track record of bringing innovative, growing companies to public shareholders, and we expect that our merger will enhance our ability to innovate and grow as we strive to provide the highest customer experience to our expanding customer base.”

Darrell Crate, chairman of Easterly, adds, “Sungevity makes solar simple and now will provide public investors the opportunity to gain exposure to the accelerating growth of the solar adoption curve. We believe that our merger with Sungevity will accelerate the pace of its growth and create superior value for our shareholders.”

According to the companies, Sungevity’s existing stockholders will roll over all of their existing equity into Sungevity Holdings and, together with Sungevity’s management, retain approximately 58.8% ownership, assuming no redemptions by Easterly’s stockholders.

The transaction has been unanimously approved by both boards of directors of Easterly and Sungevity and is expected to close in the third or fourth quarter of this year, subject to other approvals.

Easterly Acquisition Corp. is a special-purpose acquisition company established by asset management firm Easterly Capital.

Is It Time To Take Advantage Of Panel Recycling?

The global solar photovoltaic (PV) boom currently under way will represent a significant untapped business opportunity as decommissioned solar panels enter the waste stream in the years ahead, according to a new report released by the International Renewable Energy Agency (IRENA) and the International Energy Agency’s Photovoltaic Power Systems Program (IEA-PVPS).

The report, titled “End-of-Life Management: Solar Photovoltaic Panels,” offers a projection of PV panel waste volumes to 2050 and highlights that recycling or repurposing solar PV panels at the end of their roughly 30-year lifetime can unlock a large stock of raw materials and other valuable components.

The report estimates that PV panel waste, consisting mostly of glass, could total 78 million tonnes globally by 2050. If fully injected back into the economy, the value of the recovered material could exceed $15 billion by 2050. The report says this potential material influx could produce 2 billion new panels or be sold into global commodity markets, thus increasing the security of future PV supply or other raw-material-dependent products.

“Global installed PV capacity reached 222 GW at the end of 2015 and is expected to further rise to 4,500 GW by 2050. With this tremendous capacity growth will come an increase in waste associated with the sector,” comments IRENA Director-General Adnan Z. Amin. “This brings about new business opportunities to ‘close the loop’ for solar PV panels at the end of their lifetime. To seize these opportunities, however, preparations for the surge in end-of-life material should begin now.”

“With the right policies and enabling frameworks in place, new industries that recycle and repurpose old solar PV panels will drive considerable economic value creation and will be an important element in the world’s transition to a sustainable energy future,” adds Amin.

The report suggests that addressing growing solar PV waste - and spurring the establishment of an industry to handle it - would require the adoption of effective, PV-specific waste regulation; the expansion of existing waste management infrastructure to include end-of-life treatment of PV panels; and the promotion of ongoing innovation in panel waste management.

“Experience with electronic waste tells us that developing technological and regulatory systems for efficient, effective and affordable end-of-life management requires long lead times,” explains Stefan Nowak, chairman of IEA-PVPS. “This timely report can be used by public- and private-sector institutions to anchor the necessary investments in technology and policy research and development and supporting analyses to unlock the significant recoverable value in end-of-life panels.

“Responsible lifecycle management is an imperative for all PV technologies - the socioeconomic and environmental benefits which can potentially be unlocked through end-of-life processes and policies for this waste stream in the future should be seen as an opportunity today to start extending the photovoltaic value chain,” adds Nowak.

The report notes that PV panels fall under the classification of “general waste” in most countries, but the European Union (EU) was the first to adopt PV-specific waste regulations, including collection, recovery and recycling targets. The EU’s directive requires all panel producers that supply PV panels to the EU market (wherever they may be based) to finance the costs of collecting and recycling end-of-life PV panels put on the market in Europe.

Tornado Hits Canadian Solar’s Funing Factory

Canadian Solar Inc. has announced that a severe tornado damaged its solar cell factory in Funing County, Jiangsu Province, China.

According to the company, the tornado occurred in the afternoon of June 23 and caused property damage and personal injuries. As of press time, the Funing solar cell facility has been shut down while the company assesses the extent of the damage.

Canadian Solar notes it carries various forms of insurance, including for its facilities and employees, and it is reviewing the extent and scope of this coverage with its insurance carriers. The company says it expects to recover substantially all of its financial losses through insurance. Canadian Solar’s other wafer, cell and module manufacturing facilities in China and abroad are not affected.

“Our thoughts are with the families of Canadian Solar employees and the local residents impacted by the severe weather,” comments Dr. Shawn Qu, chairman and CEO of Canadian Solar, in a press release. “We are assessing the situation but do not expect it to have a material impact on our business.”

Funing is the newer and smaller of the company’s two solar cell factories in China. Canadian Solar says it was anticipating that solar cell production from the Funing cell factory would reach approximately 267 MW in the third quarter of this year, representing 15% to 20% of its solar cell requirements for the quarter. The company now plans to cover its solar cell needs by increasing the output from its Suzhou, China, solar cell factory, ramping up production at its new cell factory in Thailand and purchasing additional solar cells from its long-term third-party suppliers. As a result, the company says it expects to fulfill its module delivery commitments and maintain its annual module shipment guidance.

Solar Will Provide Most U.S. Distributed Renewables

The U.S. is expected to deploy 77.3 GW of distributed renewables between this year and 2025, with the majority of the capacity driven by solar installations, according to a report from Navigant Research.

The report says distributed solar installations will total almost 75.8 GW during the period, and cumulative capacity is projected to be evenly split between residential (49%) and commercial (51%) customers.

Distributed renewables technologies, which also include wind power and biogas, have unique characteristics that can act as generation and/or load control on the grid; however, the report says they each represent a dynamic resource that is challenging the industry’s prevailing business models and operating procedures. During the last decade, improvements in regulatory policies and technology cost reductions have accelerated distributed renewables deployments in the U.S.

Roberto Rodriguez Labastida, senior research analyst with Navigant Research, says, “As distributed renewables continue to evolve from their identity as fringe generation resources to become the workhorse of the power sector, it is important that all electricity sector stakeholders execute a new strategy around renewables in order to remain relevant.”

New & Noteworthy

PG&E Plans To Shutter State’s Last Nuclear Plant

si body si body i si body bi si body b dept_byline

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph