301 Moved Permanently

Any type of crystalline PV module assembly strategy in the modern era must be assessed in the context of product oversupply. The global glut of low-priced modules shapes manufacturers’ equipment purchase plans; their process development paths; and, of course, their decisions to open, expand, idle or close their factories.

Right now, conversations with executives at module assembly equipment suppliers and module manufacturers reveal relatively quiet times, with little unveiling or widespread implementation of process breakthroughs. Most steps of the crystalline module assembly process are considered mature and developed at this point.

However, the global factory landscape presents several compelling geographic trends - some of which could continue to affect the industry once supply and demand return to balance and weaker players have exited the market.

China remains the dominant player in crystalline module manufacturing for the moment, leading to continued questions in the industry on whether Chinese manufacturers will adopt automation to the same degree as their Western counterparts.

“In China, they do not use a lot of automation,” remarks Roger G. Little, chairman of the board, CEO and president of Spire Corp., a Bedford, Mass.-based solar equipment supplier. “So, we can talk about new equipment and new tools, but the Chinese are not - at this point - adopting much of that.”

Instead, tasks such as cell stringing continue to be performed by hand in Chinese factories, Little reports. “Hopefully, once we get through this oversupply period and they are able to improve their lines, they will adopt more automation,” he adds.

Other industry executives see more automation-minded evolution in Chinese factories, despite manufacturers’ current woes.

“The degree of automation in Chinese factories is steadily catching up with [that of] Western production facilities,” says Axel Riethmüller, executive vice president of solar technology at teamtechnik Group, a Germany-based solar equipment supplier. “It has long not been possible to detect any difference in the equipment or levels of automation used by leading Chinese manufacturers.”

For other factories in China, Riethmüller attributes growing interest in automating module assembly to rising wages, greater demand for higher-quality product and a lack of skilled labor in China.

Little predicts that once the module backlog clears, factories in China may consider investing in automation and other new technologies, especially equipment required for assembling cells that use new high-efficiency techniques, such as solar cells that can take advantage of blue light.

“We’ll see how readily they adopt technologies for greater efficiencies,” Little says. “They will need new soldering machines, new simulators and encapsulants to allow blue light through.”

Riethmüller says manufacturers have already shown interest in upgrading to certain module assembly technologies, such as special high-throughput stringers designed for cells that use metal-wrap-through technologies.

Advances in cell technology will continue to drive small tweaks to the assembly process - particularly in the areas of soldering, encapsulation and simulation, Little says. Machinery can always be improved to run faster or be built less expensively. But the basic building blocks of module assembly do not require dramatic change, he adds.

New turnkey locations

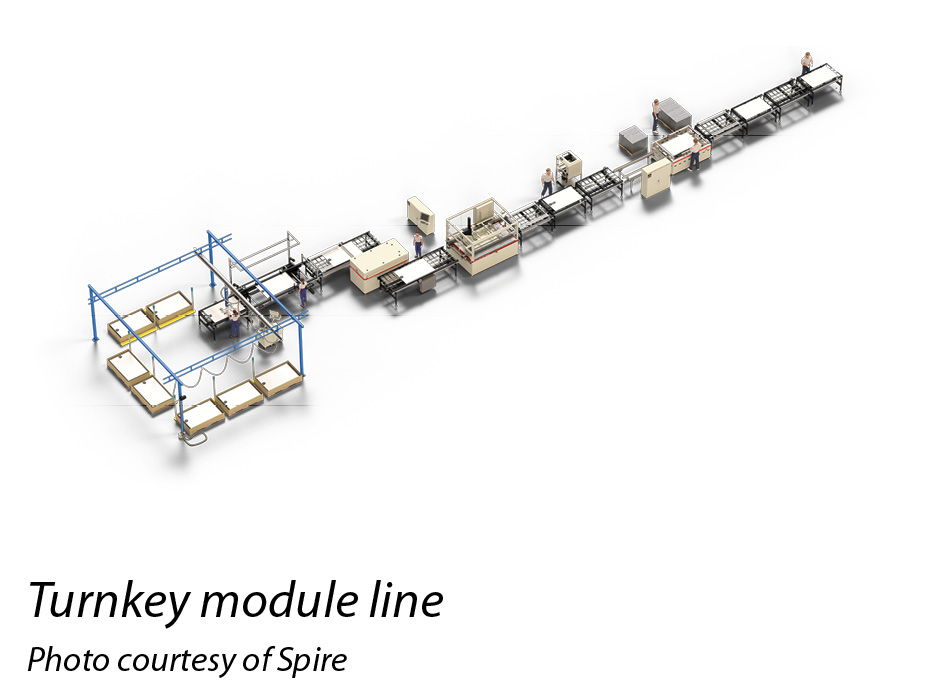

Module assembly activity also still exists outside of China, and according to Little, these lines around the world play an important role in serving their local regions - many of which are emerging PV markets.

“People don’t want to import modules from China forever,” Little says. “That’s driving regional manufacturing, and that drives turnkey lines.” He estimates that approximately 15% of module demand is met by assembly capacity at regional facilities.

Sited in India, Bangladesh, Ethiopia and several Middle Eastern countries, these turnkey module lines often use cells and materials imported from China, allowing them to be cost-competitive with module imports from China, Little explains.

Government incentives further support such initiatives, which can be undertaken by offshoots of large, diversified companies, governmental organizations or, less commonly, startups. “In Ethiopia, we put in a factory that was affiliated with a government entity,” Little says. “That’s the same as we’ve seen in many places in the Middle East.” The Indian lines, in contrast, tend to be launched by entrepreneurs and diversified firms.

Although he believes some demand still exists for turnkey solutions from “newcomers to PV production,” Riethmüller is less optimistic than Little about future growth of regional turnkey lines.

“The market for turnkey solutions has shrunk as customers have built up their own expertise,” he says.

Domestic assembly

In the U.S., where several crystalline module factories have shut down in the past few years in the face of low-cost international competition, some new factories could follow a model designed to ensure that all completed modules can be sold and installed in the field.

The concept of locating a manufacturing facility close to a large planned utility-scale installation is not new; solar technology supplier Applied Materials launched its fab2farm model in September 2009.

“The fab2farm model represents a complete regional ecosystem, bringing together communities, utilities and solar panel manufacturers to drive down the cost of solar electricity, create green jobs and spur local economic activity - while delivering a supply of clean energy for decades to come,” Applied Materials boasted in a press release at the time.

Each 80 MW SunFab production line constructed as part of the fab2farm model was designed to produce modules eight times larger than traditional models. Installed costs were estimated to be less than $4.00/W.

Since the launch of fab2farm, the solar module manufacturing market has undergone countless changes - including the substantial pullback from the sector altogether by Applied Materials. Thin film, the chosen technology for the SunFab line, has largely fallen out of favor, and the industry’s cost-reduction trajectory makes the $4.00/W figure from 2009 less impressive. (Applied Materials ceased SunFab sales in 2010.)

However, the basic concept of locally sited module assembly may be poised to make a comeback. Spire’s Little reveals that the company is currently developing plans for crystalline module assembly lines that can produce kilowatt-sized modules locally for large-scale utility solar developments.

“This drives balance-of-system costs in the solar farm down significantly,” he explains. “It also makes competition from imports much more difficult because it’s costly to ship modules that large from China.”

Creating module assembly lines to produce panels measuring 2 meters by 5 meters requires enlarging every piece of equipment. Although Spire has completed some machinery, such as simulators and laminators, to accommodate supersized modules, the complete line has yet to be built.

For the final push toward commercialization, the company is currently working on a proposal to seek a partnership with the U.S. Department of Energy (DOE), Little says. Pending approval of its DOE application, the company plans to work under an 18-month program with the agency and formally launch the products thereafter.

Until - or if - manufacturing equipment for supersized modules becomes widely available from Spire or other equipment providers, pursuing such a model remains a challenging and expensive proposition for manufacturers, teamtechnik’s Riethmüller points out.

“This increases the costs compared to production equipment for standard formats and also the risks in terms of production availability and quality,” he says. “Certain production processes would definitely have to be established in a different form.”

Local manufacturing of standard-size modules to supply specific projects, on the other hand, already exists in the U.S. For instance, in February, Nexolon America, a subsidiary of South Korea-based Nexolon Co. Ltd., broke ground on a factory in San Antonio to supply modules to OCI Solar and CPS Energy’s 400 MW solar farm.

The factory, which will conduct both cell and module production operations using wafers imported from South Korea, is expected to reach 200 MW in annual capacity by summer 2015, says Scot Arey, chief of staff at Nexolon America. “We expect full capacity to go to OCI Solar to meet its obligations to CPS,” he adds.

Module assembly and other production steps will feature a high degree of automation, according to Arey. Nevertheless, the company plans to hire plenty of locals from the San Antonio community through its partnership with regional educational partners.

Despite the absence of supersized modules - Nexolon America must meet standard-size module specifications per its contract with OCI Solar - Arey’s characterization of the localized module manufacturing model may strike some solar professionals as reminiscent of Applied Materials’ 2009 fab2farm vision.

“We applaud San Antonio’s vision of adopting solar and bringing in the manufacturing to create it right here,” Arey says. “This changes the ‘value of solar’ calculation immensely because not only are there long-term energy savings realized by CPS and San Antonio residents, but just as important is the economic impact of new jobs, both directly in Nexolon America, as well as [for] the supporting regional industries.” R

Process: Crystalline Module Assembly

For PV Module Assembly, Factory Geography Plays Increasingly Important Role

By Jessica Lillian

Regional and even local module manufacturing facilities are springing up in the U.S. and beyond.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph