301 Moved Permanently

Although the PV inverter has been overshadowed recently by developments in the PV module supply chain, more attention is being placed on this technology. In fact, the last several months have been good ones for the solar PV inverter market.

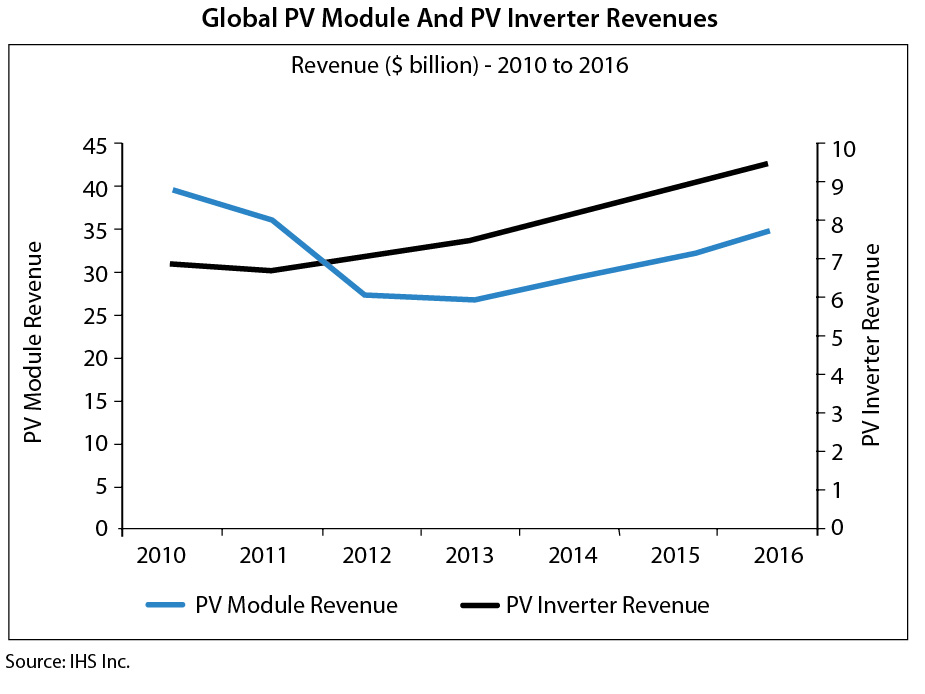

Unlike many module suppliers, inverter manufacturers have been very cautious in their expectations of future demand and have maintained capacity and inventory levels at relatively healthy levels. As a result, PV inverter prices have been far more stable than those of PV modules, and the outlook for inverter revenues looks very different.

And unlike global PV module revenues, which declined by 25% in 2012, PV inverter revenues grew by 5%. Inverter revenues are forecast to continue growing, increasing a further 5% to $7.5 billion in 2013.

This article looks at some key changes and challenges that the inverter sector will encounter in the next few years.

Emerging markets

The revenue growth in the inverter space has been driven largely by important growth markets in Asia, such as China, India and Japan. An increasingly large complement of emerging markets is becoming an important part of global demand.

Demand for PV inverters is continuing to shift from the established European markets of Germany and Italy, which previously accounted for much of the market. Although Europe accounted for over 80% of installations in 2010, its share is predicted to fall to 37% in 2013.

Inverter manufacturers are understandably trying to position themselves strategically in these emerging markets to take advantage of the large growth opportunities, but this is no easy task. Suppliers cannot possibly address all of these new markets, so choosing the correct ones is essential, and entering them requires significant investment and resources to provide a minimum level of sales and after-sales support.

Providing high levels of such support is becoming increasingly important for PV inverter suppliers to gain and maintain customers. Meeting the after-sales service requirements of customers is a growing challenge for suppliers, particularly as they enter new PV markets. Some large industrial suppliers with businesses other than in PV may already have a global network of offices and personnel located in these markets. These companies can relatively easily train their staff to provide after-sales service and support to new customers, whereas other manufacturers that do not have a similar global footprint may have to rely on third-party service technicians to provide after-sales service in a cost-effective manner. Or, these companies may need to set up new regional offices.

Local content requirements are also making entering some new markets challenging and risky. Some countries, such as South Africa, require local content commitments in order to bid on PV projects. This situation is likely to continue, particularly in some Middle Eastern countries such as Saudi Arabia. To be active in these markets, suppliers are required to make significant upfront investment in local manufacturing facilities and partnerships.

Evolving supplier base

Although SMA Solar Technology AG continues to be the dominant supplier in terms of global market share, it is not immune to the fragmenting PV market. In fact, the company’s market share declined in 2012 for the third consecutive year. Although it has maintained a strong position in its core markets, its absence in China and Japan - which accounted for a growing share of demand, particularly in the second half of the year - resulted in its share of global revenues falling to just 25%, having been as high as nearly 40% in the past.

SMA has made moves to combat the erosion of its share, such as the recent acquisition of a majority stake in Chinese supplier Zeversolar to gain access to the rapidly growing Chinese market. It has also gained Japanese certification and is aggressively pursuing this market.

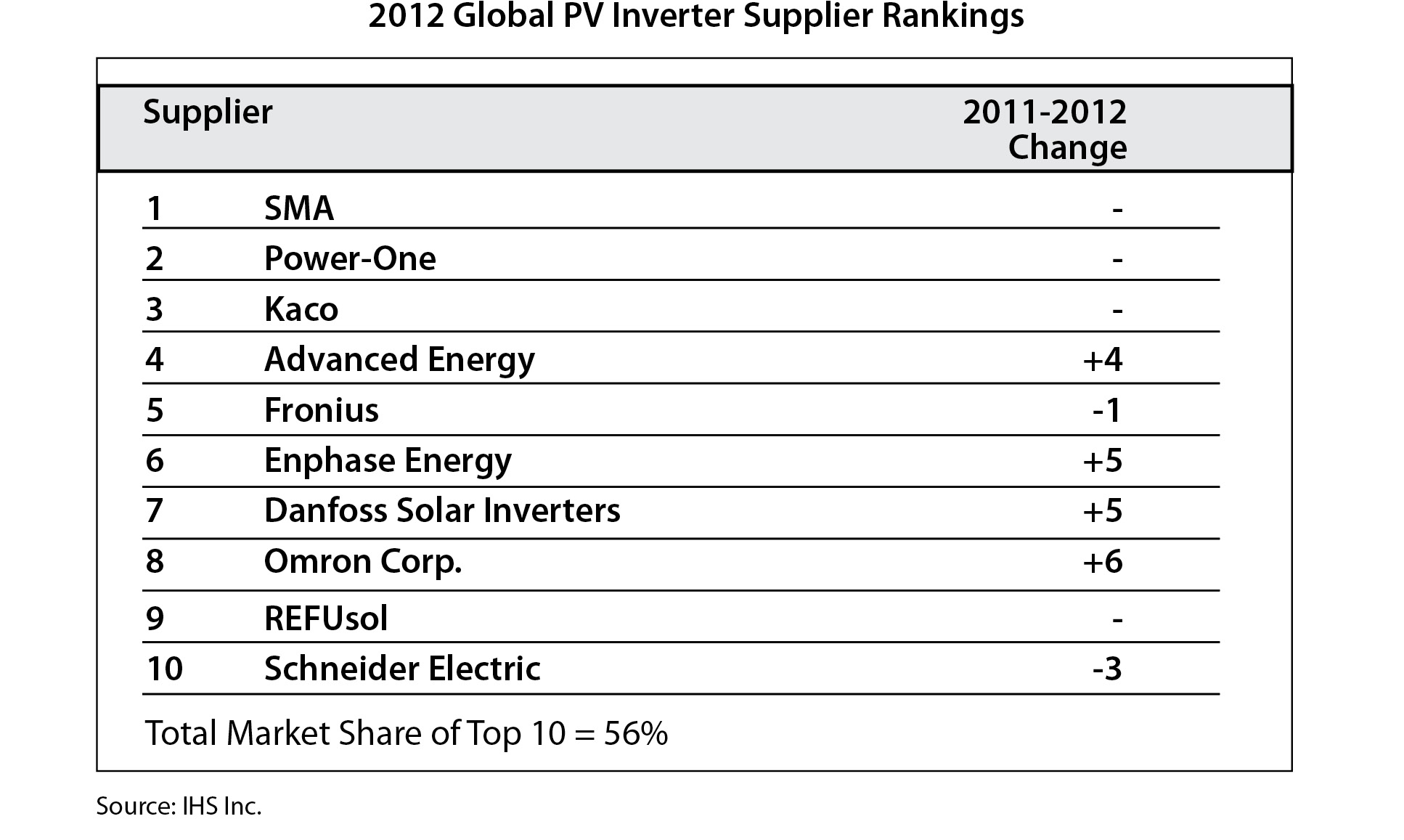

SMA was not alone in losing market share in 2012. In fact, the other inverter manufacturers in the top three, Power-One and Kaco New Energy, also slipped in terms of market share for reasons similar to what ailed SMA.

Three suppliers dropped out of the top 10 supplier list, including Satcon and Siemens. The former declared bankruptcy, and the latter chose to withdraw from the market.

Conversely, a number of manufacturers increased their share of the global market in 2012, largely because of their presence in fast-growing markets. The leading micro-inverter supplier, U.S.-based Enphase Energy, moved up the ranks to become one of the top 10 suppliers for the first time in 2012, after capturing an increasing share of the U.S. residential market. Omron Corp. also appeared in the top 10 for the first time, largely due to its position as the leading supplier in the Japanese market.

Particularly in the fourth quarter of 2012, a number of Asian inverter manufacturers also gained significant market share because of the large volume of installations in Japan and China. Chinese and Japanese inverter manufacturers with a strong local market share, such as Sungrow, Omron and Tabuchi, increased their share in the final quarter of 2012 at the expense of other inverter suppliers, whose core markets slowed. This trend is likely to continue in 2013.

Other changes in the PV inverter supplier base have recently occurred through major mergers and acquisitions announcements. U.S.-based supplier Advanced Energy acquired Germany’s REFUsol in April in a bid to widen its geographical presence and product portfolio. Both companies have been strongly focused on the commercial sectors of the PV markets in their respective regions.

The commercial market has historically been a very important segment in Europe and is forecast to account for an increasing share of the Americas market in the coming years. Advanced Energy also gained REFUsol’s strong portfolio of three-phase string inverters, which have taken massive share away from central inverters in commercial systems. Annual global shipments of three-phase string inverters will double in the next four years.

Shortly after this acquisition was announced, Swiss industrial electronics giant ABB announced that it was acquiring the second largest PV inverter supplier, Power-One. ABB, which already had some business in the PV inverter market, will be able to build on Power-One’s well-established presence in most of the largest PV markets by leveraging its global manufacturing, sales and service network.

Inverter configuration

European inverter manufacturers have been strongly promoting the use of small three-phase inverters in large power plants. In recent years, Danfoss and REFUsol have used such products in large power plants of up to 80 MW in size in Europe, rather than larger central inverters.

This trend is likely to be increasingly seen outside Europe. There are several reasons why this solution may be preferred, such as the often comparatively short lead time of smaller inverters or unique site conditions that may make using heavy central inverters prohibitively expensive. Also, having more inverters results in more maximum power-point trackers distributed around the plant, which leads to more granular monitoring.

With three-phase inverters, downtime and operational costs can also be reduced, as the failure of one inverter will not affect as much of the system, and faulty inverters can more easily be replaced.

Micro-inverters

In the past, micro-inverters have been used almost exclusively in residential systems. However, over the last year, they have been increasingly installed in commercial installations of up to 1 MW.

Enphase has been very active in promoting micro-inverter use in commercial installations in North America to reduce the effects of shading or roof orientation. Micro-inverters also help reduce installation time and downtime, as they are easy to install or replace.

As a result, micro-inverters have captured market share from string inverters in the U.S., and this trend is forecast to continue in the coming years. Although micro-inverters accounted for just 15% of the U.S. market in 2010, they are forecast to account for 23% in 2013.

Micro-inverters have also been launched in new markets, such as the U.K. and Australia. Typically, micro-inverters are more quickly adopted in new markets, where customers and installers are not as familiar with PV technology and, therefore, more open to new concepts. These markets are often also associated with very low pricing, as they are targeted as new opportunities by new inverter suppliers, predominantly from China.

The high upfront price per watt of micro-inverters (still more than double that of standard string inverters on average) is one of the most commonly cited reasons for not using them.

The PV inverter market is constantly evolving and adapting to new technologies and changes in the wider PV industry. Recent activity by suppliers, including a number of major acquisitions, has shown them to be strategically gearing up for long-term growth in this market. Overall, the market will continue to expand, reaching nearly $10 billion in 2016. S

Market Report: Inverters

Global PV Inverter Market Holding Up Quite Well

By Cormac Gilligan & Sam Wilkinson

The sector actually grew in 2012 - and is forecast to continue along that path.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph