301 Moved Permanently

There will be much garment-rending among solar sector advocates and professional organizations over the impending end of the U.S. investment tax credit (ITC) for solar power projects. Sotto voce, developers and financiers say they are expecting the ITC to go quietly at the stroke of 2017.

There is some hope that Congress may issue a reprieve of sorts by allowing solar projects to qualify for the 30% credit if they are in progress by the deadline rather than completed, as was accomplished for the production tax credit for the wind industry. A bill to this effect has been proposed in the Senate, and the passage of the 2014 farm bill with the energy title intact is a good omen. But few really expect the actual sunset of the ITC to be pushed back.

The question on many minds is, can solar power remain cost effective in the U.S. in the absence of such a significant incentive? Increasingly - and with growing confidence - the answer is, yes.

“People who worry about the ITC are missing the reality that we really are driving down the cost of solar,” says Paul Detering, CEO of REC Solar Commercial Corp., which was recently reorganized as a dedicated business serving the commercial solar sector when Mainstream Energy spun off its residential business to Sunrun.

According to Detering, successful companies in the solar sector have made effective use of incentives to build their businesses and are now prepared to operate without them if need be. He says the impending end of the ITC was definitely a factor in Mainstream’s decision to embark on a new strategic direction, and it is a sign that the solar sector is maturing, with companies able to rise or fall on the merits of their business models.

“I could have used one more year of grants,” says Michael Gorton, CEO of Texas-based power provider Principal Solar Inc., in a tone suggesting a shrug. “The good news is that with the feds going away, solar will be less political.”

There are three basic steps to achieving a viable solar sector: reduce soft costs, improve access to capital and avoid a solar panel trade war with China. That last one is looking sketchy, but the other two conditions seem to be within easy reach.

A hard look at soft costs

According to the U.S. Department of Energy (DOE), the photovoltaic industry is more than 60% of the way to achieving its target of $0.06/kWh. In the U.S., the average price for a utility-scale PV project has dropped from about $0.21/kWh in 2010 to $0.11/kWh at the end of 2013. Citing figures from the U.S. Energy Information Administration, the DOE says the average U.S. electricity price is about $0.12/kWh.

The huge drop in the cost of PV panels in the last five years is far and away the most significant factor in the overall reduction in the cost of solar power in the U.S. In 2010, fully $0.11 of the cost per kilowatt-hour was borne by the costs of the solar panels alone. In 2013, the costs of the panels declined to about $0.04/kWh.

On the other hand, the soft costs associated with solar power projects have remained stubbornly high over the same period, although they have come down somewhat. In 2010, soft costs imposed nearly $0.07/kWh on the price of solar. In 2013, approximately $0.05/kWh could be attributed to soft costs. Soft costs now represent the largest portion of the per kilowatt costs of solar power. According to the DOE, permitting, installation, design and maintenance account for more than 60% of the total cost of installed rooftop photovoltaic systems in the U.S.

A 2012 study by Clean Power Finance found that more than one-third of U.S. solar installers believe that permitting requirements are limiting market growth. In November of last year, the DOE awarded eight teams a total of $12 million to develop streamlined and standardized solar permitting and grid interconnection processes in the second phase of the Rooftop Solar Challenge program, part of the department’s SunShot Initiative for reducing the costs of solar power.

Last August, the East Bay Green Corridor in California fielded an independent initiative to streamline the permitting process for residential solar installations in the region’s nine cities. The group, working with state officials and area cleantech businesses, also received funding from the SunShot Initiative.

REC Solar’s Detering says solar businesses would do well to hold a mirror up to their own organizations if they want to find soft costs to eliminate.

“You have to drive down transaction costs and increase the return on capital,” he says. “To do that, you have to look at your business flow. You’ve got to build the flow of business. It’s like a river. You are generating a stream of cash.”

Detering says one of the most important ways to control transaction costs is to get a grip on the all-important power purchase agreement (PPA) from a document perspective. The PPA has evolved into a complex monster of a form running 30 pages or more. REC Solar is working to standardize its PPAs and other transaction-oriented documents and would welcome an industry-wide effort to do the same.

“We want to make it more like a mortgage and less like negotiating the national debt,” Detering says.

Capital improvements

As solar power projects become seen in terms of assets and revenue streams, conversation in the solar sector is turning to finance and access to capital. One of the major differences between the industry of today and that of even a few years ago is where the money is coming from to get projects up and running. While federal and state governments continue to play a supporting role in backing solar development, the developers themselves are finding easier access to inexpensive capital from the private sector.

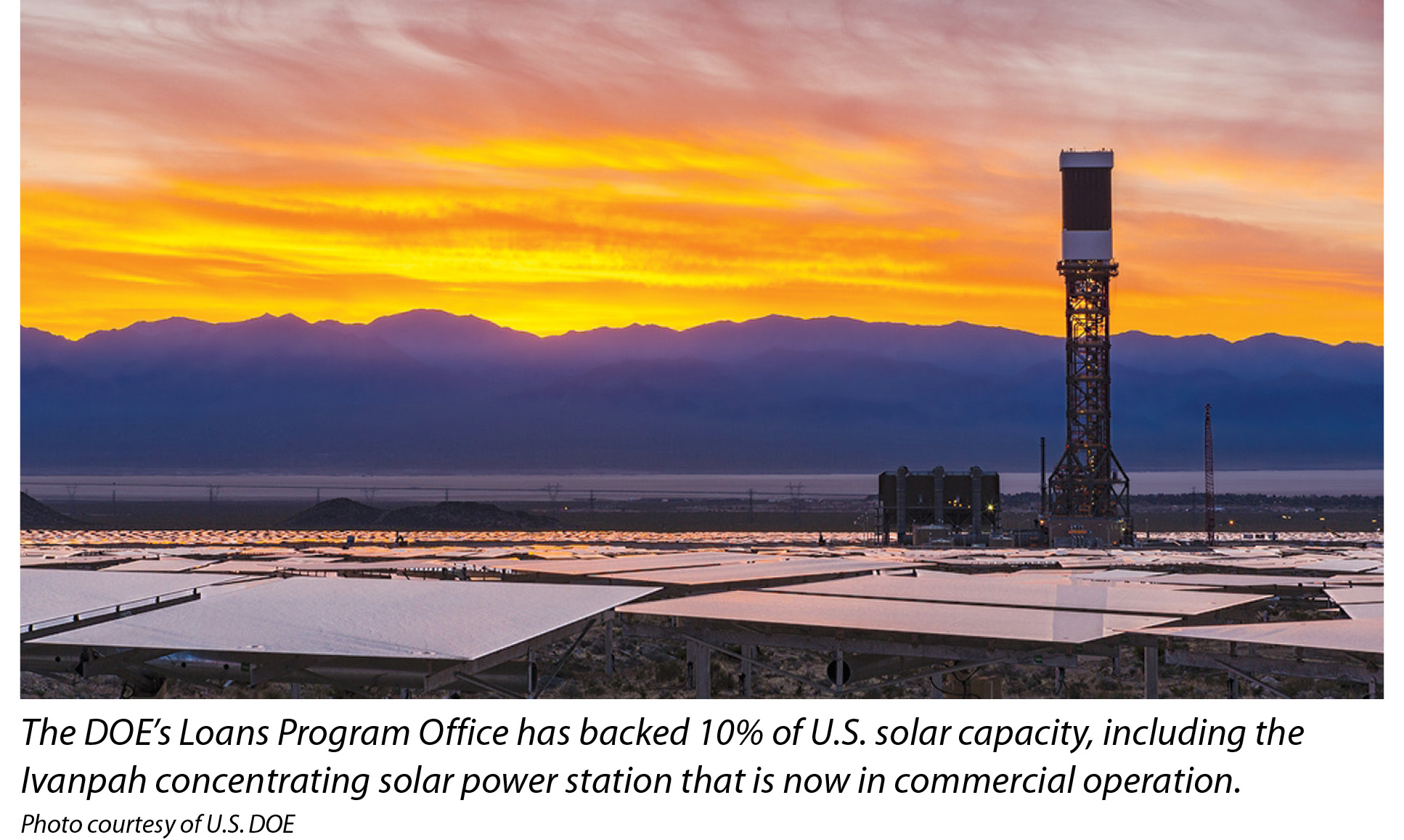

Of the 10.25 GW of solar capacity installed in the U.S. as of the end of 2013, about 10% of that total was funded by the DOE’s Loans Program Office (LPO). In 2010, when utility-scale PV was looking as if it might take off, Peter Davidson, executive director of the LPO, says many developers wanted to get into the business but had difficulty attracting bank financing.

“The technology risk frightened off the banks,” Davidson says. “The lenders would not lend.”

From the LPO’s perspective, the equity was there, and the income from off-takers was there. While PV technology was well established, it was not yet proven for very large utility power projects. By stepping in and providing the first loans for utility-scale PV power in the U.S., Davidson argues, the LPO essentially made utility-scale PV possible.

“The first three hundred-plus megawatt solar PV projects in the U.S were funded by the loan office,” Davidson says. “We’ve given loan guarantees on the next two.”

At the state level, “green bank” programs backed by governments aim to provide financing opportunities and greater liquidity to the renewable energy marketplace. The New York Green Bank, for example, will offer loans and grants to further clean energy deployment, coordinate and leverage the state’s clean energy spending, and alleviate financial market barriers that currently impede the flow of private capital to clean energy projects.

To capitalize the program, the New York State Energy Research and Development Authority filed a petition with the state Public Utility Commission to allocate approximately $165 million in uncommitted funds from the energy efficiency portfolio standard and the renewable portfolio standard (RPS). When fully capitalized, the green bank is expected to have $1 billion to use to help secure financing for renewable energy projects.

Rather than simply providing grants, states are finding ways to work with sources of private equity to back loans to solar project developers rather than holding the loans themselves. In Connecticut, the state’s Clean Energy Finance and Investment Authority (CEFIA) has partnered with solar project crowd funding provider Mosaic and Sungage Financial to package loans made to homeowners for building PV power systems into investment opportunities.

CEFIA has provided an initial $5 million commitment to fund originations of the consumer loans. Participating solar installers serving the Connecticut market will be able to offer the loans to their customers. The loan product, developed by Sungage Financial, uses projected energy savings as the basis for the offering. Investments in the loan pool will be offered to accredited investors through Mosaic’s crowd-source investment website. The Hampshire Foundation Inc. has also committed $1 million of its own funds and will offer investment opportunities to its clients as part of the program.

Bert Hunter, CEFIA’s chief investment officer, says his agency’s role in the partnership is to fund transactions as they are qualified but not hold the loans themselves for any length of time. As the process moves forward, Mosaic and Hampshire step in to take the loans over for packaging as investments.

Andrew Redinger, managing director and head of KeyBanc Capital Markets’ utilities, power and renewables group, says the solar sector is definitely on track to becoming not only a financially viable industry on its own terms, but an attractive one from an investment standpoint.

“Now with private equity getting into the space, distributed solar generation is at a transition point,” he says. “I’m excited.”

It is possible to date a movie or TV show - at least the period in which it is set - by the size of the mobile phones. Soon, any non-flatscreen held to the ear will seem quaint. Similarly, Redinger argues, the solar sector is coming through the early adopter stage and conditions are ripe for the solar sector to evolve in the U.S. on its own merits, and we are likely to look back on this period in history with some bemusement.

“The solar industry is in the ‘brick cell phone’ phase,” Redinger says.

Classic blunders

In a practical sense, there is real danger in ignoring the market economics of renewable energy and trying to force adoption through ambitious government programs. One of the strategies for achieving grid parity is to make traditional forms of energy so expensive that solar and other renewable sources seem economical by comparison.

There is a big difference between energy costs that are high in spite of the availability of renewable energy and high rates because of renewable energy. The latter condition invites political reevaluation of commitments to renewable energy. In Germany and Australia, for example, government RPS targets are being reevaluated as current high energy prices are perceived as damaging to their respective economies.

According to a report from the DOE’s National Renewable Energy Laboratory, solar power electricity generation in the western U.S. could become cost-competitive without federal subsidies by 2025 if new renewable energy development occurs in the most productive locations. California, Arizona and Nevada are likely to have surpluses of solar resources, the report says, and seem likely to provide a regional bulwark of cost-effective solar power, unless environmental or other siting challenges limit in-state development.

The rapid growth of the solar sector in the U.S. is undeniable. A recent survey of employment in the solar sector conducted by The Solar Foundation (TSF) reports that since 2010, U.S. solar sector employment has increased 53% and now employs more than 142,000 people at about 18,000 locations. Andrea Luecke, TSF’s executive director, says the most important driver in the expansion of solar sector jobs in the U.S. has been the precipitous drop in the cost of solar power and the corresponding increase in installed capacity.

More to the point, the TSF study says much of the job growth can be attributed specifically to the steep decline in the cost of solar panels. If there is a threat to the economic future of solar power in the U.S., an end to inexpensive solar panels seems a likely culprit.

“Never get involved in a land war in Asia” - one of the classic blunders according to Vizzini in “The Princess Bride.” A corollary for the solar sector might be, “Never get involved in a trade war with China.” The future commercial viability of the solar sector in the U.S. may rest on that sage advice. S

Industry At Large: Solar Sector Viability

The U.S. Solar Sector Prepares To Stand On Its Own After ITC Sunset

By Michael Puttré

Developers and investors say the impending end of the investment tax credit will not diminish solar power’s growth potential.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph