301 Moved Permanently

According to the National Renewable Energy Lab, the potential market for rooftop commercial and industrial (C&I) solar photovoltaic projects in the U.S. may exceed 100 GW by 2030. And yet, despite this immense potential, the commercial solar market has been largely stagnant over the last several years.

A recent industry report has shown virtually zero growth in U.S. commercial solar installations from 2012 through 2014 - a stark contrast to the dramatic growth experienced by the residential and utility-scale solar markets. The industry has also seen several large solar players, most notably Real Goods Solar, recently exit the commercial segment due to poor performance.

Why is there a disconnect between the C&I solar market’s great potential and its lackluster recent results? In our opinion, it is simply that C&I solar projects are inherently difficult to originate and execute. It’s a challenging environment, and in order to be successful, C&I developers must maintain flexibility and adeptly navigate any number of obstacles.

Site challenges

Up front, there are a number of site-related obstacles that must be surmounted on most commercial solar projects. For rooftop solar projects, the age, condition and type of roof surface are critical factors. Many projects are derailed due to adverse roof characteristics, usually related to older roofs that are poor candidates for solar. In these cases, we advocate for roof replacement, ideally with new roof surfaces featuring 20-plus-year roof warranties compatible with the proposed solar system.

Structural considerations for rooftop projects are another key constraint. The good news is that today’s racking systems are extremely lightweight, and we are typically able to design and install fully ballasted, non-penetrating rooftop mounting solutions with a distributed load in the three- to five-pounds-per-square-foot range - well within the reserve tolerance of most commercial buildings.

We recently completed a 1.6 MW project involving three buildings for convenience store distributor Harold Levinson Associates (HLA) in Farmingdale, N.Y., which has one of the largest commercial rooftops in the state. An interesting aspect of this project is that two of the hosting roof sites, although located across the street, are very different.

One warehouse has a metal standing-seam roof while the other has a membrane roof. For the metal roof, we specified the S-5! PV kit, which secures 816.5 kW of Trina Solar panels to the S-5! clamps that attach to the roof seam. No rails were used for that array. The membrane roof hosts a PanelClaw 15° tilt ballasted racking system supporting 699 kW of modules. A third location in the same complex, which houses offices, hosts a 144.4 kW array that also uses the PanelClaw ballasted system. All of the three arrays use Advanced Energy 500 kW central inverters.

For all C&I solar projects, a comprehensive structural assessment by a qualified professional engineer is a critical step. For the HLA job, we hired a surveyor to make a detailed survey of the roofs before we started laying out the modules. That was really helpful. After we received the survey, which included the height of the obstructions, we performed a shading analysis that allowed us to figure out which areas to avoid to ensure that panels are not shaded.

A detailed geotechnical engineering report is an absolute necessity for C&I ground-mount projects, as is an environmental site assessment to determine any underlying contamination issues. Unlike many greenfield utility-scale ground-mount projects, C&I ground-mounts are often sited on previously used industrial land areas. We recently completed a 777 kW ground-mount for Croda, a global specialty chemical manufacturer, that we installed on remediated land previously used as an oil tank terminal.

Utility interconnection of medium to large-scale distributed generation projects pose another key hurdle for C&I candidates. Although more and more utilities have been able to provide an early indication of potential interconnection costs and issues, in order to fully understand the implications of these systems, a formal interconnection study is required, which adds time and cost. By underestimating interconnection challenges, developers can expose themselves to unwarranted risks. An early indication of interconnection feasibility can save the hassle of overcoming other obstacles associated with C&I project development.

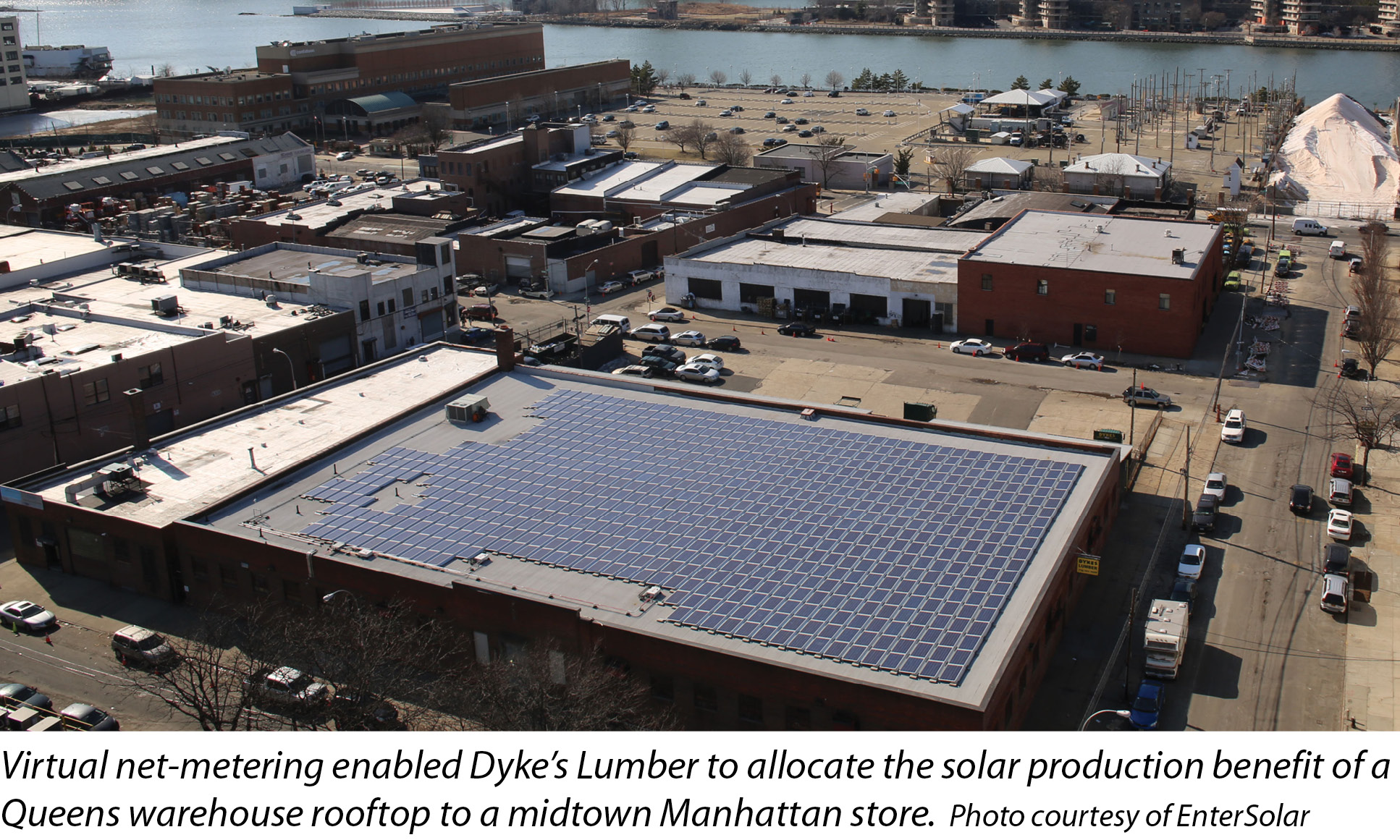

An interesting potential solution for many site-specific solar challenges is the increased prevalence of “remote net metering” (a.k.a., “virtual” or “community” net metering), which allows the benefits from an off-site solar PV system to be allocated to different locations.

One of our clients, Dykes Lumber Co., has a retail location in midtown Manhattan that uses a lot of electricity, but the store is not a good physical candidate for solar. We were able, however, to install a rooftop solar system on one of their warehouses in Queens, which, although it had a terrific membrane roof for solar, did not have a significant on-site load. The system features PanelClaw ballasted mounting supporting Motech panels. By utilizing remote net metering, we were able to allocate the benefit of the warehouse rooftop system’s solar production to the store located in midtown New York City.

Financial challenges

Unlike the residential solar market, the commercial market does not readily lend itself to standardized “cookie-cutter” financial structures and documentation. C&I clients invariably insist on negotiating and modifying project documentation, and as a consequence, each individual solar project tends to have its own unique features. The bespoke nature of C&I projects is a major problem and results in significantly higher transaction costs on a relative basis as well as an increased cost of capital relative to the residential market.

Although there are inherent reasons for the ad hoc nature of C&I project development, the situation can be improved. Developers should strive to maintain as much consistency in their projects as possible, and we fully support the industry’s adoption of standardized project documentation - such as the Solar Access to Public Capital commercial power purchase agreement (PPA). We also are participating in the truSolar Working Group, which is attempting to establish uniform project screening, rating and underwriting standards for C&I solar projects. Several other players, such as Mercatus and Wiser, are working on similar standardization-driven solutions.

Host credit-quality requirements are another financial challenge facing the C&I solar market. Many solar investors require that PPA counterparties have “investment grade” credit ratings (i.e., rated BBB- or better). In reality, most potential C&I solar customers across the U.S. do not have formal credit ratings, and many businesses that are rated are not investment grade.

The ubiquity of FICO credit scores for individuals and the related ability to securitize pools of specific risk profiles is a major driver of the residential solar market. Although there is no simple corollary for FICO scores in the C&I market, we are seeing a number of trends that we believe can serve to mitigate this host “bankability” issue, including the standardization efforts mentioned above, as well as the proliferation of specialty solar finance entities that are willing to finance non-investment grade counterparties - after appropriate financial due diligence.

Another interesting potential credit “fix” is the availability of property assessed clean energy (PACE) financing, which is an innovative long-term financing tool that can be more forgiving from a credit quality perspective. We are currently working on a solar PPA for a non-investment grade client in Connecticut for which we are using PACE financing as a form of credit enhancement.

The prevalence of owner-tenant facilities across the C&I universe is yet another obstacle for solar developers in that it creates another layer of complexity and often another “mouth to feed.” In our experience, the key to solar project success for leased facilities is getting an early indication of the relationship between the tenant and the landlord, as well as a good understanding of the terms of the lease and the specifics of the facility itself. Various solar incentive programs, such as feed-in tariffs, are well suited for leased facilities because the on-site usage is not particularly relevant to the solar project economics.

Origination and selling challenges

Engineering and financial issues aside, one of the greatest challenges solar developers face with potential C&I candidates is simply getting in the door. In today’s competitive business environment, folks are extremely busy, and for many businesses, exploring the feasibility of a solar project is just not a priority. Finding the appropriate contacts within C&I organizations is tough, and once found, capturing their attention can be tougher still.

In our experience, identifying an internal solar project “champion” within the client’s organization early in the sales process can be a huge help. We experienced this firsthand while developing a 600 kW metal rooftop PV project with S-5! clamps and Hanwha panels for Stewart’s Shops in Saratoga, N.Y. - our sales efforts had reached an impasse until a very senior executive within Stewart’s took a keen interest in the project; this internal solar advocate was pivotal in our getting approval.

The multifaceted decision-making processes within many commercial institutions is another barrier to success. From the chief financial officer, to the chief strategy officer, to the facility manager, to the energy procurement team, green-lighting a C&I solar project often requires the approval of many different constituencies within a company. Developers must understand the different objectives and concerns of each decision-maker and should facilitate reaching a consensus whenever possible.

Another selling constraint we frequently come up against is the erroneous assumption that solar PV projects are comparable across geographies and/or time periods. “We looked at solar a few years ago, and the numbers just didn’t pencil” is something we hear a lot.

Oftentimes, potential solar project champions have already expended a lot of time and energy - and internal political capital - on a failed effort to get a solar project approved and, thus, are reluctant to reconsider. It is important to emphasize to prospective clients that solar project economics are wildly variable depending on the specific location, the availability of state and/or local incentives, and the associated retail cost of electricity.

Several years ago, we completed an 877 kW solar project for Chelten House Foods in Bridgeport, N.J. The project featured a SunLink ballasted racking system with Trina Solar panels. When we were done, the client was eager to pursue a similar PV installation for the company’s facility in Henderson, Nev., but was discouraged to learn that the achievable project returns were not nearly as attractive as those of their existing system.

The good news is that, due to the significant reduction in solar equipment costs, the Nevada project returns have improved over the last year, and our client is once again considering the project. As most developers understand all too well - but not so many prospective clients - solar project economics can differ dramatically over time and by location.

The result of the aforementioned challenges is a lengthy C&I sales cycle, with 12- to 18-month lead times being quite typical. Commercial clients tend to perform significant due diligence throughout the sales process, which can be quite time intensive for project developers. Even in the best of circumstances, the success rate for C&I projects is very low, with fewer than one in 10 prospects leading to completed projects in our experience.

Successful C&I developers understand these factors and build their businesses to have the flexibility to address these constraints. R

Marketplace: Commercial & Industrial Rooftop Solar

Commercial Rooftop Success: A Little Ballast And A Lot Of Business Sense

By Peyton Boswell & Joe Stofega

C&I solar developers must overcome many technical and financial challenges to gain and keep a foothold.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph