301 Moved Permanently

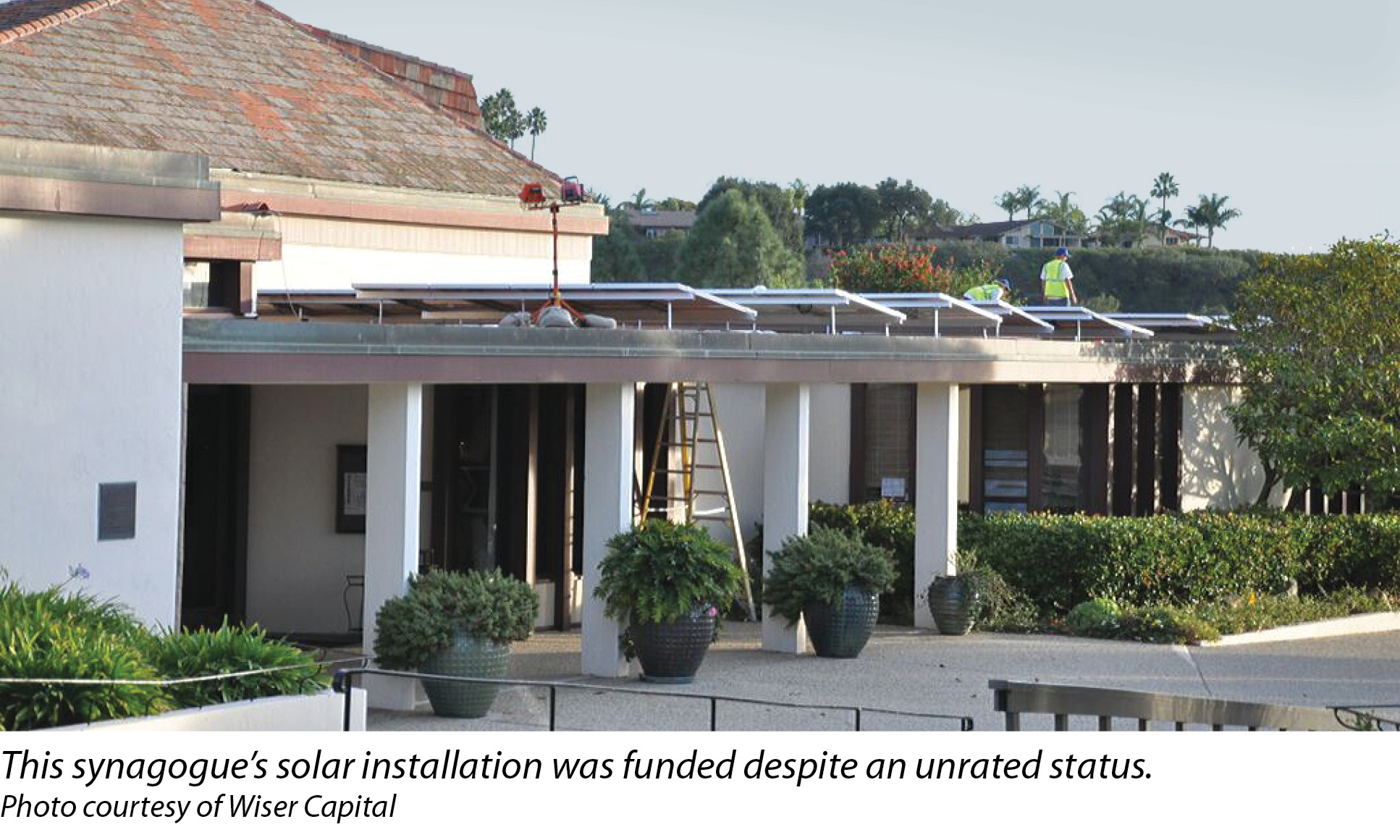

The unrated solar market has previously been looked at as “untouchable” to the majority of investors due to a lack of public debt ratings that assess creditworthiness. Likewise, solar installers have shied away from unrated deals because few host facilities can take the investment tax credit and provide the upfront capital required to make projects viable.

These unrated projects have seemingly been dead in the water - but the unrated market is poised for huge growth due to newfound methods for evaluating bankability.

Before diving into the key traits to look for in an ideal unrated project, let’s define what an unrated facility is. An unrated facility is a commercial enterprise that lacks a public debt rating; this could be anything from a nonprofit, religious facility or regional chain to a small or midsize business. In contrast, a rated project is a residential or commercial project wherein the homeowner has a FICO score or a commercial business, such as Walmart, has a reliable public debt rating.

There are millions of businesses that fall into this unrated category, so what should we be looking for to determine if an unrated project is a strong candidate for financing?

Longevity

A good first step is to seek out facilities with historic stability. Approximately half of all new businesses fail in the first five years of operation. Therefore, businesses with an operating history of greater than 10 years are ideal candidates for financing.

Additionally, we need to factor in long-term potential. Even though markets will change, facilities such as distribution and manufacturing centers, homeowner associations or wineries are likely to retain their use types, which decreases risk to the investor.

Start-ups are avoided, and facilities with high turnover rates - such as multi-tenant offices or retail spaces - should be minimized, as there is a higher likelihood that the tenant or facility will end up switching hands before the end of the financing term.

Gauge risks

Risks can be grouped into three main categories: business risks, facility risks and project risks. All of these risk factors determine project viability and make the difference between a project moving forward or not.

Business risks involve the financial standing of the organization, including creditworthiness and long-term viability. Two important measurements of creditworthiness are liquidity and growth trends. Ideal liquidity means the company needs sufficient assets to cover three months of liabilities; six-month coverage is ideal. Growth trends take into account sales, expenses and margins. Although allowances are given for nonprofit and government facilities, these trends should be stable or increasing.

Facility risks include specifics such as roof age and orientation, as well as engineering and insurability. For instance, one project that we investigated on one of the Hawaiian Islands looked promising until a site review concluded that the facility was located in a high-risk flood zone. No insurance company would insure the project, so it did not move forward despite an otherwise ideal location and organization.

Project risks span everything from utility policies, such as rate and tariff structures, to permitting procedures and project servicing. The current net energy metering discussions across the U.S. are adding uncertainty to future solar projects, and some companies are pulling out of states completely.

Find strong partners

Strong manufacturing and installation partners help streamline project assessment and construction, ensuring projects are completed in an efficient manner.

Specifically, financiers are looking at panel and inverter manufacturers’ ability to stand behind their equipment warranties. Robust warranty terms without financial backing are virtually worthless.

Likewise, installation partners need the financial strength to support their workmanship warranties. This means they need a solid balance sheet and viable business plan.

This approach is different from the “low-cost leader” position we have often seen in the industry. For a cash purchase, minimizing the upfront cost of installation can mean the difference between a sale and a pass. For power purchase agreements, under which electricity is being sold over a 20- to 25-year term, maximizing production and uptime on the system is vital to ensuring the investor receives its expected return. Partners with track records of success, as well as efficient servicing and warranty resolution, can make the difference between investment losses and gains.

Transparency

Transparency for unrated projects is critical if we want to truly capitalize on such a significant market. For instance, our firm scores such projects using a proprietary automated process that calculates the bankability and risk of an unrated solar project by assigning a score, similar to a FICO score. This approach brings all parties together to understand the risks and viability of a potential project.

In 2015, we financed the first tranche of unrated commercial deals using this scoring process. The risk assessment process allowed an industrial bank that had never financed an unrated deal to enter the space with confidence. It also allowed a number of nonprofits and small businesses that had previously been hamstrung by a lack of financing to switch to solar.

Going forward, we expect to see institutional investors enter the market, thereby expanding the number of projects that can get funding and driving down the cost of capital.

O&M

Once a project is off the ground, having a long-term plan for operations and maintenance (O&M) is key to its success. Benefits include increased performance, project longevity and lower repair costs. Most unrated facilities aren’t big enough for dedicated staff, but the project’s ongoing performance is vital to solidifying investor returns.

In turn, having long-term solar service plans for owners and financiers can create confidence that performance and returns will meet expectations. A handful of companies now exist to provide O&M services for unrated projects.

It is critical to account for the cost of these services in the project cashflows. The industry used to talk about solar being “maintenance-free,” but this is not completely true. Preventive maintenance and robust system monitoring are important for any solar array. By allocating dollars up front for these services, the system’s overall return on investment is enhanced, and the risk to the investor is decreased.

For years, the unrated market has remained untapped. But now that solar installers have been given the resources to bring strong projects to financiers, and investors are able to understand risk and transparent requirements, more projects will come to life this year.

It is up to all parties to look for strong unrated projects, helping this market gain momentum and promoting viable solar installations across the country.

System Financing

Five Factors When Pursuing The Unrated Commercial Solar Market

By Megan Birney

Certain property types have been historically difficult for solar developers and installers to reach, but that’s changing.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph