301 Moved Permanently

Cautious optimism seems to have gripped the upper reaches of the solar photovoltaic supply chain. If 2014 is the year that brings balance back to the market after the freefall of years previous, a little upswing for 2015 would be welcome indeed.

Buoyed primarily by demand from PV wafer and cell manufacturers in China and the delayed ramp-up of new production capacities, polysilicon prices in the third quarter of this year are heading north - cautiously. This is the assessment of Germany-based polysilicon market research firm Bernreuter Research.

“We expect the spot price to climb up to $23/kg from the current $21/kg before it will drop to a range of $18/kg to $20/kg by the end of 2014,” says Johannes Bernreuter, head of Bernreuter Research.

Bernreuter notes that major polysilicon projects with a total capacity of 66,000 metric tons (MT) slated to come online this year have experienced delays, including the following:

- South Korea-based Hanwha Chemical started operation with an annual capacity of 10,000 MT in late 2013, but is reportedly facing difficulties in ramping up capacity;

- China-based Daqo New Energy was planning to complete its expansion from 6,150 MT to 12,150 MT by the end of 2014, but ramp-up will only begin in 2015;

- SMP, a joint venture of SunEdison with Samsung Fine Chemicals in South Korea, has postponed the start-up of its 10,000 MT plant, which uses fluidized bed reactor (FBR) technology, to the second half of 2014; and

- China-based GCL-Poly Energy Holdings has also postponed the first 10,000 MT phase of its 25,000 MT FBR plant.

“We assume that only 10,000 MT to 15,000 MT of the new capacities will become effective by the end of 2014; hence, oversupply will not be an issue this year,” Bernreuter says, indicating that next year may be a different story.

It is interesting to note that SMP and GCL-Poly are both introducing relatively new technologies to the FBR process, which is seen as a promising alternative to the traditional Siemens process that currently dominates the polysilicon market for semiconductors, primarily due to its high-purity output for computers and electronic devices.

New bedfellows

IHS Technology reports that although FBR technology faces challenges related to quality control, its relatively low cost and lack of toxic byproducts will raise it up in the next few years. While the FBR process is expected to account for only about 10% of the production of global PV polysilicon, IHS says the process will account for 16.7% of the market by 2020.

“FBR takes less energy, shortens crucible fill times and produces more silicon per cubic meter of reactor space, as the crystals have a larger total surface area than the rods used in the Siemens process,” says Jon-Frederick Campos, analyst for solar research at IHS. “FBR presents many benefits of high interest for polysilicon producers, with advocates for the technology saying that FBR can produce output at a cash cost of $10 per kilogram in the foreseeable future - a sizable decrease in cost versus the $14 per kilogram promised by its best-in-class Siemens counterparts.”

Theresa Jester, CEO of California-based Silicor Materials, notes that polysilicon prices started the year at $20/kg and cites industry analysis forecasting an increase in demand of 25% over the course of the year, which would be expected to also increase costs. For its part, IHS forecasts continuously increasing PV demand in 2015 through 2018, with annual growth rates of 10% to 15%. To meet this increasing demand, IHS says global operational polysilicon capacity is expected to grow by approximately 95,000 MT.

Even if different analyses point to polysilicon costs moving slightly north or south of $20/kg for the next few years, Jester says this is still too high. Thus, an opportunity exists to squeeze costs out of the PV supply chain at the materials end.

Jester also points out that there is also room for improvement in terms of the safety and environmental impact of polysilicon production. For example, the Siemens process utilizes toxic trichlorosilane gas, which requires a robust management process to ensure it is not released into the environment. Identifying new polysilicon production processes that can eliminate the use of these hazardous materials should not be overlooked, she says.

Ice and fire

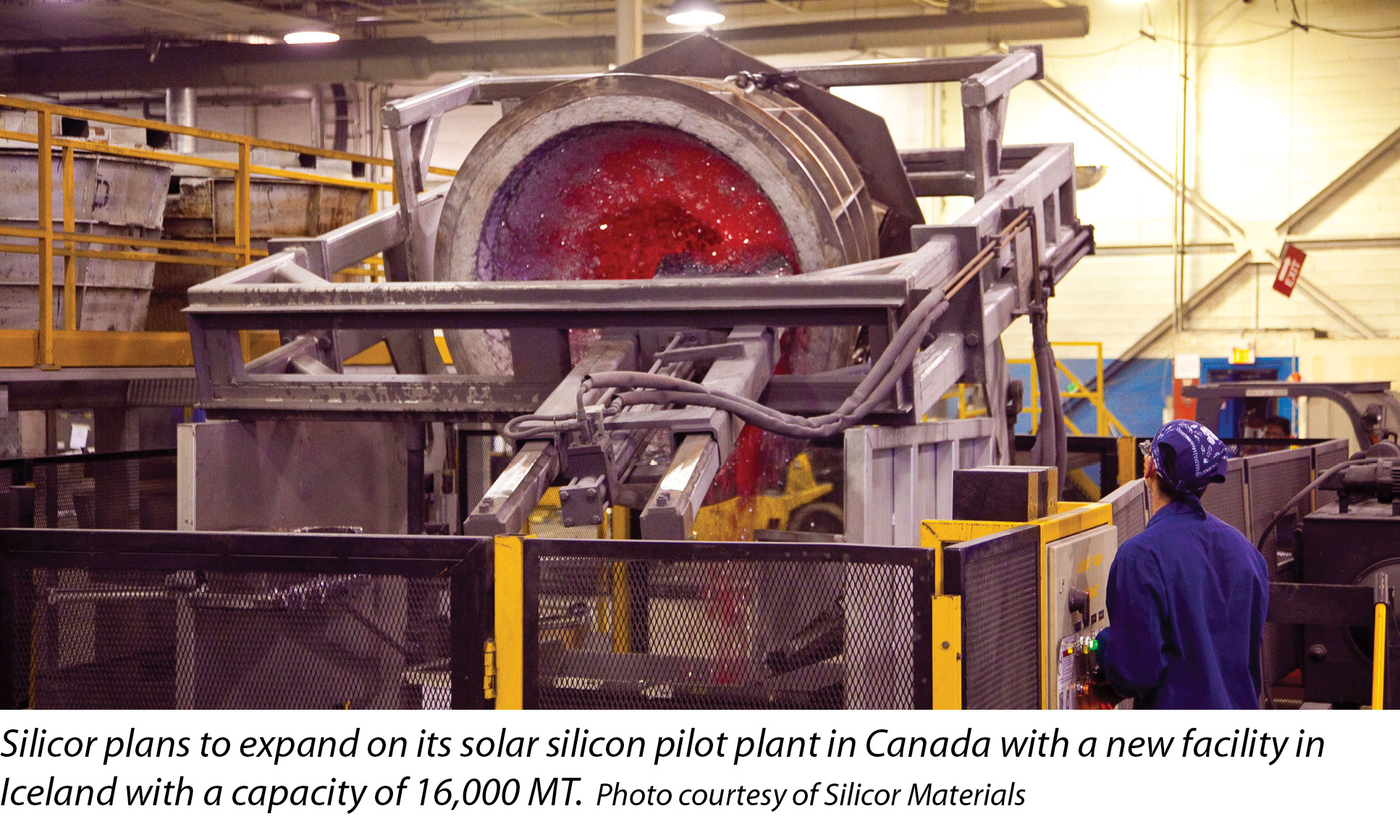

Silicor has developed a process based on aluminum smelting for producing what it calls “solar silicon.” Starting out with the same metallurgical-grade silicon used in the Siemens process, Silicor’s method - described as a variation on the upgraded metallurgical grade process - produces a material suitable for PV wafers and cells. From its pilot facility in Canada with an annual capacity of about 1,000 MT, the company has been providing quantities of its product to prospective customers on a test basis.

In September of last year, Silicor received $6 million in new funding from existing investor Hudson Clean Energy Partners LLP to support the company’s development and manufacture of its solar-quality silicon. In July, Silicor announced an ambitious plan to build a solar silicon plant in Iceland. The planned facility will have a nameplate capacity of 16,000 MT, with the ability to yield up to 19,000 MT of solar silicon per year.

Once all phases of the project are complete, the company says it will produce solar silicon at $9/kg, with a plan for further cost reductions. Pending final negotiations with Iceland officials, Silicor aims to break ground later this year and accelerate construction to bring the plant online in 2016.

The company says it holds sales commitments and letters of intent with several solar wafer, cell and module manufacturers and expects to have the Iceland facility’s nameplate capacity sold out by the end of this year. Nevertheless, in terms of the worldwide marketplace, Silicor is ramping up production at a time of considerable uncertainly with regard to polysilicon supply and demand.

“The jury is still out as to whether additional production is going to come online and remain online,” says Michael Russo, executive vice president for sales and marketing at Silicor. “In the 2017 time frame, we are still only going to be about three to four percent of the total marketplace for PV silicon.”

The company is basing its strategy more on its process than on an effort to catch a wave in global demand.

“One of the factors that lowers the overall cost of our operations is that we utilize a blending of upgraded metallurgical-grade silicon with aluminum,” says Craig Wellen, chief financial officer for Silicor. “Through our process, we produce byproducts that have value in themselves, including a master alloy and polyaluminum chloride.”

The latter, in particular, is in demand for the automotive and water treatment industries, while the master alloy is sold to aluminum producers. Also, Wellen says the fundamentals of the company’s process significantly reduce the capital expenditures required to get a plant up and running. The two-phase (solid-liquid) production process that avoids a gasification step requires less expensive equipment and consumes less energy than competing Siemens and FBR processes, he says.

Adam Bergman, Silicor’s senior vice president of corporate development, says Iceland’s business-friendly climate had a lot to do with the company’s ability to push the project forward quickly.

“We have customers who want our product, so this was an important consideration,” Bergman says.

Perhaps just as important is the fact that Iceland has signed a multi-year free trade agreement with China. As a result, Bergman says, Silicor will be able to get its product into China, which is clearly the leading country from a PV production standpoint.

Over and above its economic policies, Iceland has several geological and geographic advantages. The volcanic island nation is rich in geothermic power, and Silicor has letters of intent from local power producers to provide its facilities there with 100% renewable energy. Also, Iceland’s location in the North Atlantic provides easy access to Europe and North America, not to mention Asia if the storied Northwest Passage evolves into a significant trading route.

“If you look at the trade dispute between China and the U.S., most of the Chinese module manufacturers are looking for alternative locations outside of China,” Russo says. “Iceland might make sense.” S

Marketplace: PV Materials

New Demands And Technologies Move PV Silicon Supplies

By Michael Puttré

After delays, production is ramping up, and new partnerships are forming.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph