301 Moved Permanently

The last three months have shown that the tide can turn quickly in the solar sector, especially considering its global nature. Macroeconomic conditions in China have deteriorated, the U.S. investment tax credit (ITC) expiration is getting closer, and there has been a recent downturn in the solar stock market.

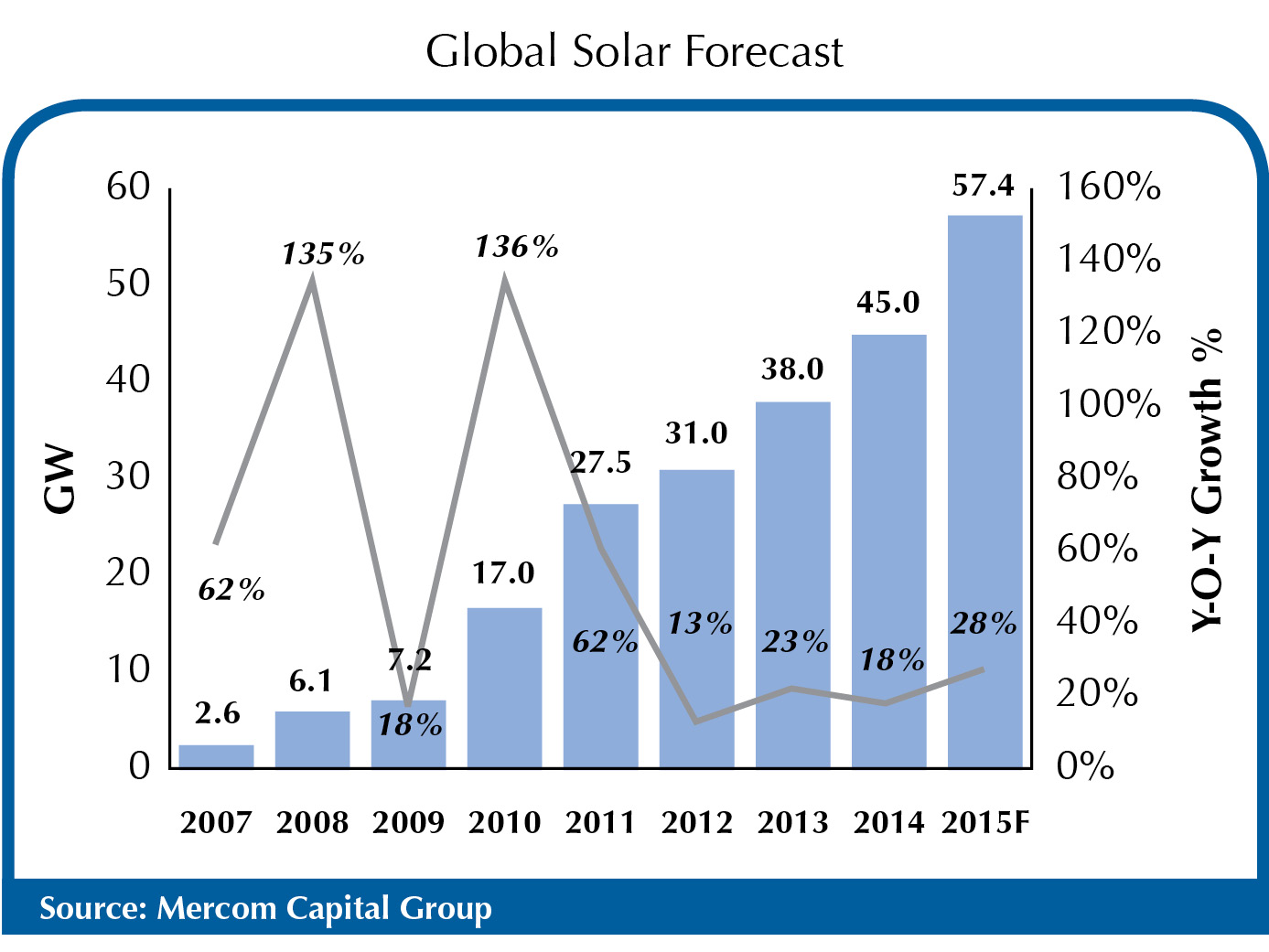

These factors have created some pessimism about the outlook for the global solar industry, yet the industry remains on pace for 25% to 30% growth this year. Mercom Capital Group, a global clean energy communications and consulting firm, estimates that 2015 global solar installations will reach approximately 57.4 GW.

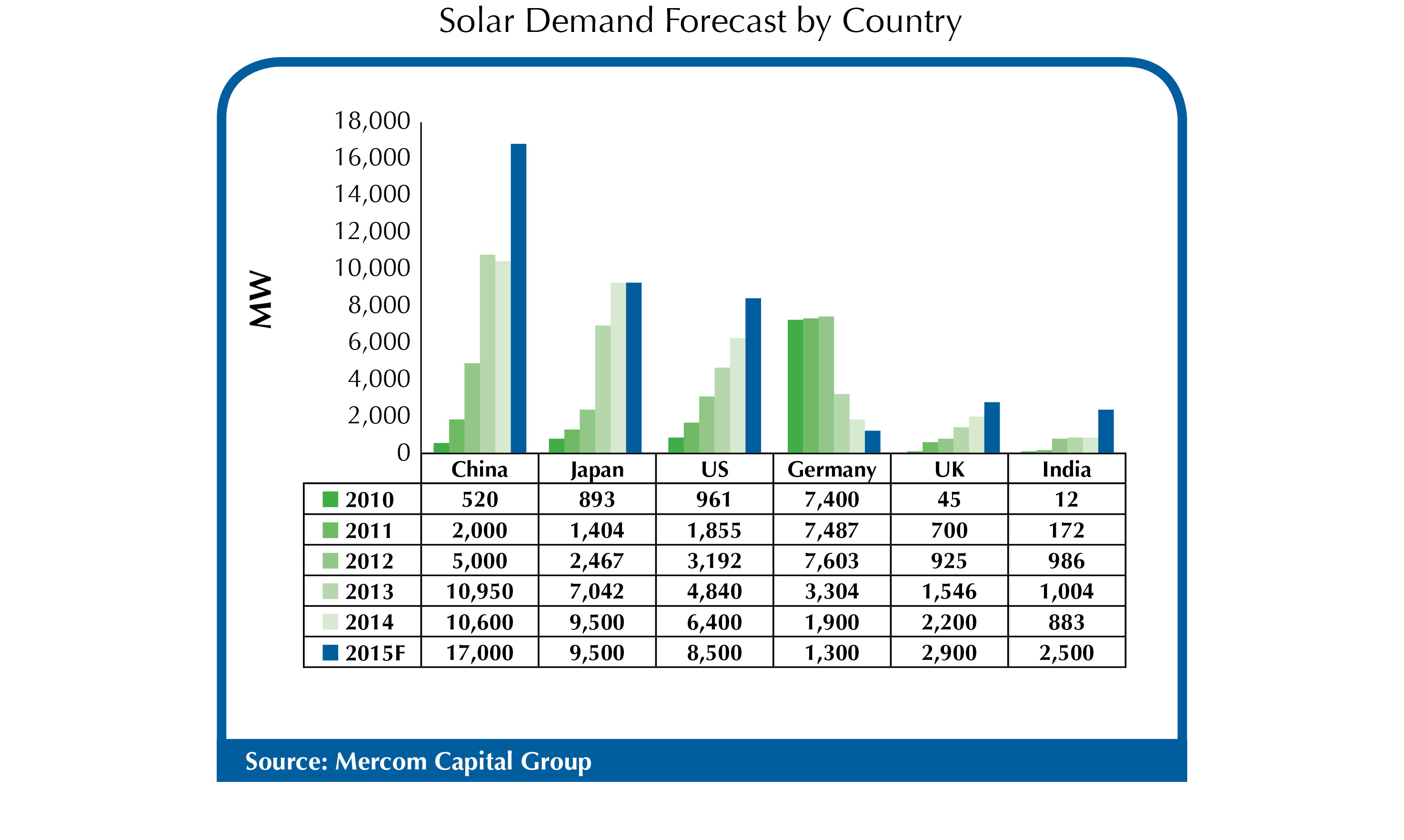

Diving into specifics about the top markets in the solar sector and their expected installation numbers for this year, the U.S. and China are expected to grow, the U.K. will peak and then subside rapidly, and India is just getting out of the gate. Japan’s numbers are predicted to be on par with last year’s, and Germany is expected to have one of its worst years ever for solar installations.

Captain America: catch me now

With a strong pipeline of projects, the U.S. market is headed for a robust 15 months of installations before the expected drop of the ITC from 30% down to 10% at the end of 2016. Mercom estimates that the U.S. will install 8.5 GW this year. The U.S. solar market has led the world in reducing financing costs by using innovative financing structures, including third-party financing, securitization and yieldcos.

Funding activity in public markets increased in the second quarter to $2.3 billion compared with $1.3 billion in the first quarter of this year. Since June, there have been three initial public offerings, raising about $1.3 billion: 8point3 Energy Partners, a yieldco jointly formed by First Solar and SunPower, raised $420 million; SunRun, a residential solar integrator, raised $250 million; and TerraForm Global, a yieldco subsidiary of SunEdison focused on emerging markets, raised $675 million.

However, over the last 90 days, solar stocks have witnessed significant declines - more than 50% in some cases - along with the crash in oil prices, although there is no practical connection between the two beyond the psychological. Yieldcos have been hit especially hard, even though there is no change in the fundamentals. It remains to be seen if the public market will recover; the ability of yieldcos to raise funds at lower costs will be significantly hampered with low market valuations.

Third-party financing firms continue robust fundraising and have been the primary drivers of the U.S. residential markets. Securitization deals announced in the last 90 days witnessed very low, sub-5% interest rates.

With a robust pipeline of more than 20 GW, the U.S. market will see record growth over the next 15 months, as projects rush to complete installations before the ITC expiration - but beyond that, there is a lot of uncertainty.

China: the will is strong, but...

In China, the long-term growth case for solar is still very strong despite the recent negative economic indicators. Air pollution, one of the fundamental reasons for renewable energy adoption in China, has long been a public health crisis, and the country desperately needs to add renewables to the energy mix in order to curb CO2 emissions. However, currency devaluation, slow growth and the stock market collapse have created a sense of uncertainty in the markets.

The numbers offer a case for some optimism. China’s National Energy Administration (NEA) announced that solar installations during the first half of the year increased to 7.73 GW compared with 3 GW installed during the first half of 2014. Mercom forecasts 17 GW will be installed for the year due to stronger first half installation numbers and on-the-ground dynamics in provinces - indicating that execution is better than last year; hence, installations of 10 GW during the second half of the year looks achievable. That said, macroeconomic headwinds, curtailment and delayed payments could be negative factors.

Cumulative solar installations to date in China are now at approximately 36 GW. In the first half of this year, most of the installations (6.7 GW) came from large-scale projects, while distributed projects contributed about 1 GW. The NEA also noted that about 9% of solar power was curtailed due to grid connection issues, mainly in two provinces. This is not a good sign for the sector, especially with higher installations expected in the second half.

A world in flux

Japan’s installations are expected to reach 9.5 GW - about the same as last year - and are expected to decline thereafter. Japan has cut its feed-in tariff (FIT) rate by a total of 15.6% this year in two steps. More importantly, Japan just restarted its first nuclear reactor since the Fukushima disaster, with additional plants expected to come online in the future. The government clearly wants to bring nuclear back into the energy generation mix and continues to reduce solar subsidies.

Japan’s long-term energy plan forecasts nuclear to make up about 22% of the energy mix, while it expects renewable energy - including hydro - to account for 24%. Citing grid stability, Japanese utilities have pushed for curtailment because they are ill-equipped to handle high levels of intermittent solar power. Unlike the previous administration, the current government’s support for renewable energy is weak. Instead, the priority has been to bring back nuclear power and curb subsidies toward renewables.

In Europe, the U.K. is poised to peak this year with record solar installations of approximately 3 GW. However, the government has announced a drastic reduction of FIT rates and is removing preliminary accreditation under the FIT scheme, which will make it difficult for the solar sector to grow after this year.

Incentives for solar power are disappearing; Renewables Obligation Certificates (ROC) for projects larger than 5 MW expired after April. The FIT program was supposed to incentivize smaller projects going forward. Now, the U.K. Department of Energy and Climate Change (DECC) has unveiled a proposal to drastically cut FIT rates by 67% to 87% based on project size. The proposal will also implement reduced tariffs beginning in January 2016.

The DECC followed this with another announcement that it is removing preliminary accreditation under the FIT scheme effective October. As a result, developers will no longer have the ability to receive a tariff guarantee during the project planning and implementation stage. Instead, tariffs will be determined after the project is completed. The Contracts for Difference (CFD) auction mechanism will replace ROC for projects greater than 5 MW. In the first CFD auction held this summer, solar only won five projects with a total of 72 MW - 32 MW of which is scheduled to be completed this year.

With most of the incentives drastically cut or eliminated by the end of the year, the future does not look very bright for the solar sector in the U.K. The government appears determined to do away with all subsidy costs associated with solar power.

Germany has installed 774 MW of solar photovoltaic capacity this year as of the end of July. This is a decrease of about 40% compared with 1,360 MW installed over the same period in 2014. A lack of incentives, changing tariff structures and European Union anti-dumping measures against Chinese modules have all contributed to depressed project internal rates of return, making this one of the worst installation years for PV in Germany in a very long time. Mercom forecasts installations in Germany to reach 1.3 GW for the year - a 32% decrease compared with last year.

After a long wait, however, there appears to be good news for the solar market in India. Solar installations have been stuck at the gigawatt level for the last three years. As of mid-August, solar installations have crossed 1.4 GW, already the best year on record for India. Mercom is forecasting installations will reach approximately 2.5 GW this year.

Recently, the government of India has officially raised the National Solar Mission’s solar installation target from 22 GW to 100 GW by 2022. The target was approved by the cabinet and is split between large-scale projects (60 GW) and rooftop projects (40 GW).

Although global solar installations continue on a growth trajectory, recent headwinds and government policies could impact longer-term growth.

Global Demand

Global Solar Installations Continue Growing Despite Recent Headwinds

By Raj Prabhu

Government policies continue to be the primary drivers of new photovoltaic capacity around the world.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph