301 Moved Permanently

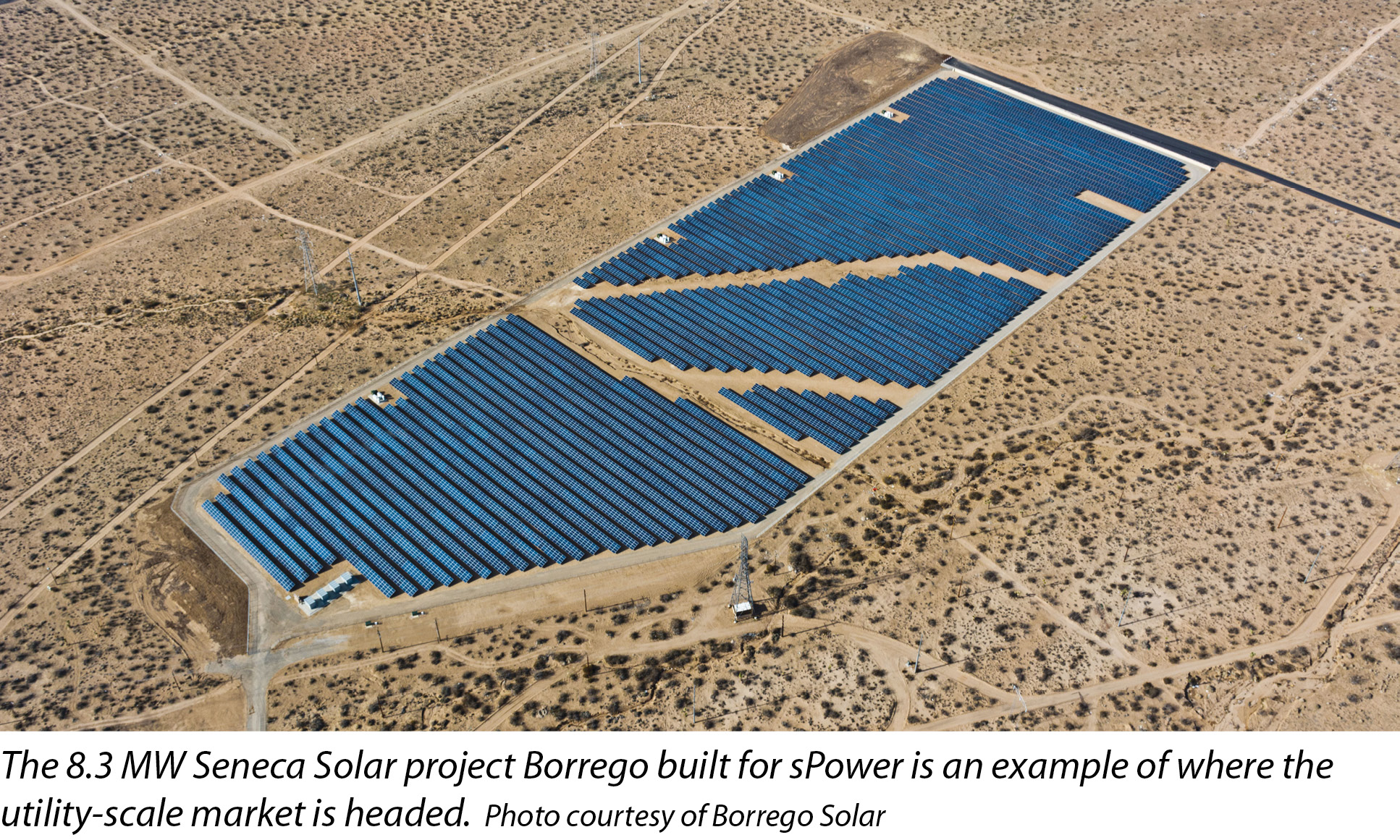

Utility-scale solar is taking on a new face in the U.S. It’s no longer limited to sprawling solar arrays in the middle of the desert; instead, utilities across the country are increasingly deploying smaller, wholesale distributed generation (WDG) projects. Whether the driver is a location-specific request for proposals, a distribution-level interconnection, or an overall desire to have projects sited in high-profile locations, a shift is occurring.

As a result, firms that want to remain profitable in an ever-changing landscape need to adapt to handling a higher volume of smaller projects as opposed to a lower volume of bigger projects.

Over the past few years, markets that were previously non-existent for utility-scale solar have become hot spots for development as a result of lower-cost structures, expensive conventional energy and carbon reduction mandates. This new class of utility solar is vastly different from the traditional facilities, requiring developers to get accustomed to smaller projects. In addition, some utilities have rolled out programs to support WDG projects sited closer to load zones in more urban areas of their service territories. Recent solicitations by Southern California Edison and New York’s PSEG-Long Island serve as examples.

Solar costs have also fallen to a point where developers can offer utilities competitive pricing for smaller-scale solar facilities under a power purchase agreement (PPA). In fact, there is a new trend within the industry of using an old tool to secure PPAs: the Federal Energy Regulatory Commission’s Public Utility Regulatory Policy Act (PURPA). Originally established in 1978, PURPA provides an avenue for qualified facilities (QFs) to secure PPAs.

Small power opportunity

Why is all of this policy talk important? PURPA set out to encourage various improvements to the electricity grid and supply. One of the ways PURPA set out to accomplish its goals was by establishing a new class of QFs that would receive a special rate and regulatory treatment. There are two types of QFs, but the one relevant to our discussion is the “small power production facility,” which is classified as 80 MW or less, with its primary energy source being renewable (hydro, wind or solar), biomass, waste or geothermal.

Thanks to PURPA, utilities are obligated to provide certain benefits to QFs. The primary benefit is an obligation to buy power at its avoided cost or a negotiated rate. Avoided cost is defined as the marginal or incremental cost for a public utility to produce or purchase energy. Without getting too deeply into the policy weeds, the market is now at a point where developers can go to a utility with a small solar QF and secure a PPA at the utility’s avoided cost. Though this avenue has always been available for project developers, the overall cost structure and compression of solar project development, construction and finance is now enabling the market to not only secure these types of PPAs, but also get them financed and built.

PURPA-qualifying PPAs are available in many states, including Oregon, North Carolina, Colorado, Utah, Idaho and Georgia, to name a few. Each market has its own intricacies surrounding its avoided cost, size limitations and preferences. Many of the markets in which PURPA activity is robust cater to projects that are 10 MW or smaller.

Adjust to scale

How can utility-scale solar firms adapt to take advantage of this growing small-scale utility project market? For the sake of brevity, I’ll focus the discussion on three of the most relevant and critical elements required for a business to adapt to this trend of smaller projects at a high volume.

Company processes. Many people in the industry - and I admit I am one of them - will tell you that each project is different and requires a unique project-specific approach. However, there is an inherent need to streamline processes to successfully complete more projects with less manpower. It’s necessary to streamline the development process by establishing and setting protocols, standard products, controls, means and methods. As those of us who have been focused on the smaller utility-project market for many years already know, it takes the same amount of time to develop a 5 MW project as it does a 20 MW project.

Although it can take the same amount of time to develop a smaller project as it does a larger project, with all other things being equal, the amount of money generated for a company is less with a smaller project on an absolute basis. Therefore, firms must be more disciplined when it comes to the design, engineering, product selection and construction. Taking the time to create a list of approved vendors, technology solutions and processes specific to each market can go a long way in increasing project velocity and execution.

Project specifics. Overall efficiency is a key consideration when working on smaller projects. There are many fixed costs involved, regardless of project size. Thus, for smaller projects, those fixed costs make up a larger percentage of total costs, requiring an additional level of scrutiny, attention and mitigation. Civil and interconnection costs are generally the largest portion of those fixed costs, so a company must have a solid team of civil and utility engineers who can quickly and competently identify, troubleshoot and, ultimately, mitigate project risks.

As is the case with developing a utility project of any size, the cleaner the site, the better it is for development. When it comes to mitigating interconnection costs associated with a project, it must be sited near a robust distribution line or substation in an effort to reduce the overall interconnection budget and the chance of experiencing distribution or network upgrades.

Unfortunately, the final civil scope associated with a project often doesn’t materialize until later in the process. To mitigate this potential cost overage, firms must proactively engage with the local jurisdiction to determine if the site will trigger road improvements or other public works-related infrastructure upgrades. Additionally, they should avoid areas where site access isn’t fully improved or will need to be improved as a result of the project.

As an example, for the 2.9 MW Desert Hot Springs project we developed, financed and built, we were required to improve the portion of the road that fronts the array. Given the project size, the added cost of paving the new section of road, curb, gutter and of burying the utility infrastructure had a big impact on the project budget. If this had been a 20 MW project, the same activities would have had relatively less of an impact. If these types of improvements cost approximately $200,000, it would be an added $0.01/W for a 20 MW project. But, for a 2 MW project, the same cost would mean an additional $0.10/W.

Project finance. The standardization of contracts, such as interconnection agreements; PPAs; site acquisition agreements (e.g., leases or purchases); engineering, procurement and construction agreements; and operations and maintenance agreements, is one of many key considerations. In project development, there are many different forms of contracts involved that ultimately get reviewed by different project finance stakeholders. If you can standardize the majority of your contracts, the process will be smoother, quicker and much more manageable.

Companies should also try to bundle projects when going through the project finance process in order to get the required scale to justify the associated costs of finance. The third-party tax-equity process, in particular, can be a costly exercise. It’s typical in the industry to pool or bundle many small projects into one project financing package to dilute what would otherwise be another burdensome fixed cost of a smaller project.

Cost-competitive, market-driven forces and sweeping policy-driven mandates will only increase the need for renewable energy to reduce greenhouse-gas pollution and modernize our electrical grid. Inevitably, every state will seek cost-effective solar energy, with WDG being an essential component of this mix. Solar firms should keep an eye out for new states to pop up as robust solar markets throughout the U.S.

The market needs efficient and experienced firms to meet the demand for these scaled-down projects. The companies that take steps to adapt procedures specific to this quickly growing project class sooner rather than later - especially the ones I’ve discussed here - will be vastly more competitive in the next stage of the solar market that’s emerging now.

Project Design

Scaling Down Utility Solar

By Aaron Halimi

Solar companies need to learn how to modify project designs to meet new market opportunities.

si body si body i si body bi si body b

si depbio

- si bullets

si sh

si subhead

pullquote

si first graph

si sh no rule

si last graph