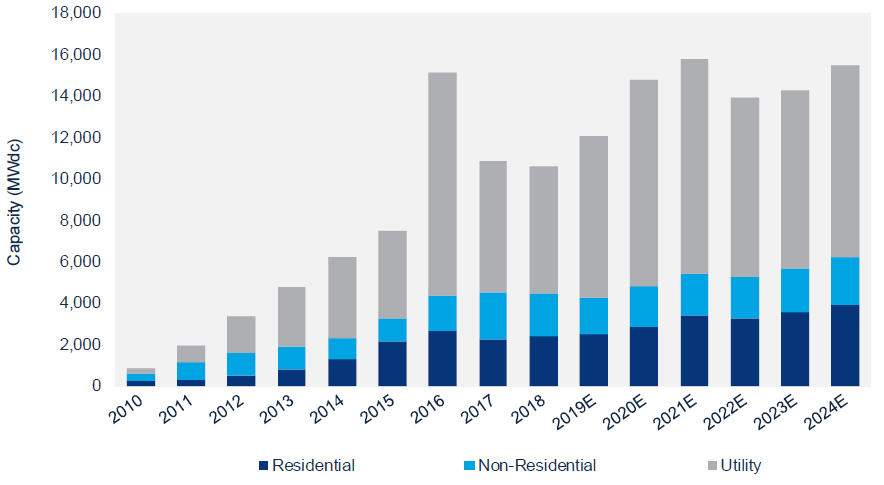

For the third year in a row, the U.S. solar industry installed double-digit gigawatts of solar photovoltaic capacity, according to a newly released report from Wood Mackenzie Power & Renewables and the Solar Energy Industries Association (SEIA).

The 10.6 GW that came online in 2018 represents a 2% decrease from 2017; however, the forecast shows the market rebounding in the years ahead, says the U.S. Solar Market Insight 2018 Year-in-Review Report. Total installed PV capacity in the U.S. is expected to rise by 14% to 12 GW in 2019, and annual installations are expected to reach 15.8 GW in 2021, prior to the expiration of the residential federal investment tax credit and a drop in the commercial tax credit to 10% for projects not yet under construction.

In Q4 2018, the U.S. solar market installed 4.2 GW of solar PV, representing a whopping 139% increase from Q3 2018 and a 4% increase from Q4 2017. Cumulative operating solar photovoltaic capacity now stands at 62.4 GW, which is about 75 times more than was installed at the end of 2008.

“The solar industry experienced growing pains in 2018, in large part due to the unnecessary tariffs that were imposed on solar cells and modules, but this report still finds significant reason for optimism,” says SEIA’s president and CEO, Abigail Ross Hopper. “The total amount of solar installed in America is on track to more than double in the next five years, proving solar’s resiliency and its economic strength. It’s clear this next decade is going to be one of significant growth.”

FIGURE: U.S. PV Installation Forecast, 2010-2024E

In addition to a market outlook, the report also details how the industry performed in 2018 in each segment.

In 2018, non-residential PV saw an annual decline of 8%, due to policy transitions in major markets such as California and Massachusetts, the report says. Utility-scale solar underwent a 7% contraction in 2018, largely related to Section 201 tariffs. There was 6.2 GW of utility solar installed in 2018, accounting for 58% of total U.S. annual capacity additions.

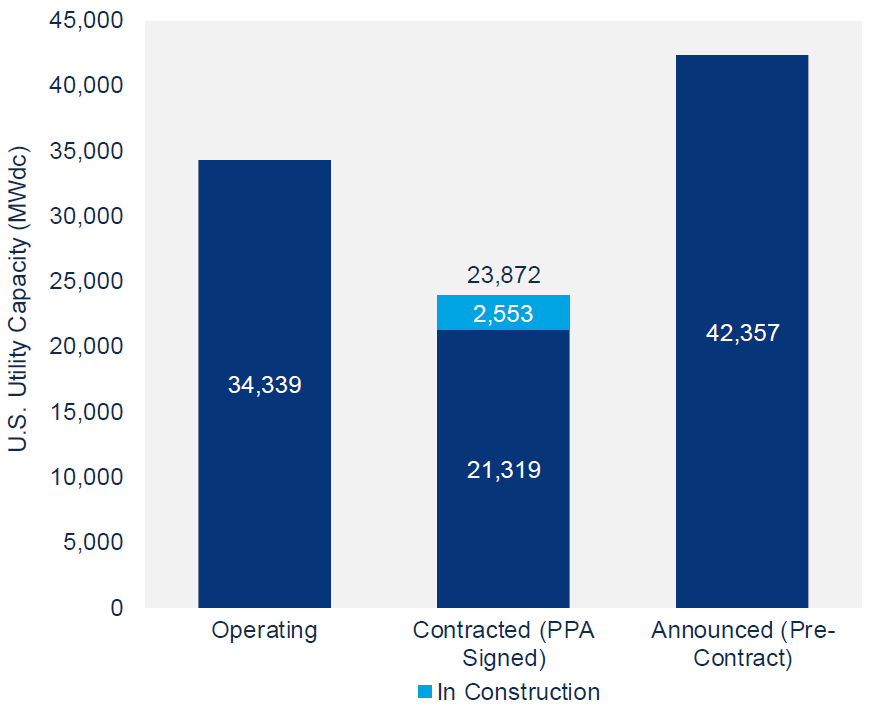

In addition, after the uncertainty of the Section 201 tariffs passed, 13.2 GW of utility solar power purchase agreements were signed in 2018, though most have expected commercial operation dates in years after the tariffs have stepped down. The contracted pipeline peaked in Q3 2018 at 25.3 GW, representing the highest in the history of U.S. solar.

FIGURE: U.S. Utility PV Pipeline

While annual growth fell in both the non-residential and utility-scale solar sectors, residential solar growth stabilized in 2018 after the previous year’s contraction. The U.S. residential solar market has now seen five consecutive quarters of modest growth, and the fourth quarter of 2018 was the largest quarter for residential solar in two years. In total, nearly 315,000 households added solar in 2018.

“After the residential solar freefall of 2017, growth in 2018 was driven by a more diverse mixture of national and regional installers than in previous years,” states Austin Perea, senior solar analyst at Wood Mackenzie Power & Renewables. “With a pivot toward more efficient sales channels, both national and regional installers exceeded expectations in California and Nevada, which drove the lion’s share of residential growth in 2018.”

The report notes that Texas and Florida – two states with generally low solar penetration – stood out in 2018, adding more capacity than some of the highest-penetration states. These emerging solar markets are poised to become the engines of growth for residential solar in the U.S., the report predicts.

In total, solar PV accounted for 29% of new electricity generating capacity additions in 2018, which is slightly less than in 2017, due to a surge in new natural gas plants.

Wood Mackenzie has increased its five-year forecast for utility PV by 2.3 GW since Q4 2018. This is the result of a large volume of project announcements; the inclusion of more solar in long-term utility resource planning; and an increase in project development, driven by renewable portfolio standards and growing corporate interest.