A new EnergySage Solar Marketplace Intel Report provides a look into the economic impact of the Section 201 solar tariff on residential customers.

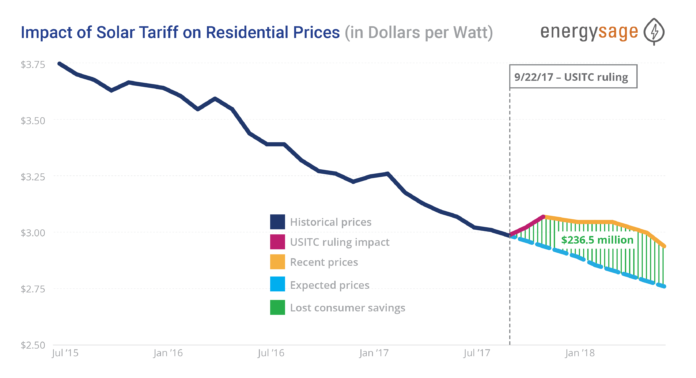

The report is based on millions of transaction-level data points generated within the EnergySage Solar Marketplace from July 2017 to June 2018. Immediately following the U.S. International Trade Commission’s finding of injury to American solar panel manufacturers in late September 2017, EnergySage saw the cost of residential solar spike on its marketplace. Though prices have since restarted their decline, they are decreasing at a slower rate than before, the report says. The result is that the cost of a solar installation is now 5.6% higher than it would have been if costs had been allowed to fall at their preexisting rate of decline, according to the findings.

For the average customer, this amounts to paying an additional $0.16/W more than they should have, or $960 for a standard 6 kW solar system. When this price increase is applied across all residential solar purchases made nationwide after September 2017, the tariff effectively created a $236.5 million tax imposed on American consumers, the report claims.

“These tariffs are yet another burden imposed on an industry that has long struggled with costs,” states Hugh Bromley, an analyst at Bloomberg New Energy Finance, an industry research firm leveraging EnergySage’s marketplace data. “The residential solar industry is fragmenting. EnergySage data allows us to monitor competition among the so-called ‘long tail’ of local and regional players who don’t publicly release their earnings in quarterly reports.”

Other key insights from the report include as follows:

- Solar costs fell nationally but rose in many top solar states: Although the cost of solar fell nationally to $3.12/W, the quoted cost of solar increased within several top solar states, such as Arizona, Florida and North Carolina. However, cost increases only occurred in states where the cost of solar was already below the national average.

- Panasonic and LG are now the two most popular solar panels: The two well-known consumer electronics brands made up 46% of all quotes submitted to shoppers on EnergySage in the first half of 2018. The Japanese and South Korean manufacturers overcame obstacles created by the solar tariff and secured greater market share.

- Solar shoppers remain very interested in energy storage: Continuing the trend first seen in EnergySage’s previous marketplace report, seven out of 10 EnergySage solar shoppers also expressed interest in installing a home battery system alongside their solar installation.

“Any trade restrictions imposed on the solar industry hurt American consumers and American workers,” says EnergySage’s CEO and founder, Vikram Aggarwal. “Yet despite these recent hurdles, the residential solar industry remains poised for tremendous growth over the next few years. All-time highs in consumer interest for solar-plus-storage, combined with falling prices and greater transparency, have mitigated the impact of these tariffs. As we show in this report, we have seen consistent increases in solar shopping levels on our marketplace across the country.”

Supported by the U.S. Department of Energy, EnergySage is an online comparison-shopping marketplace for rooftop solar, community solar and financing. The report can be downloaded here.