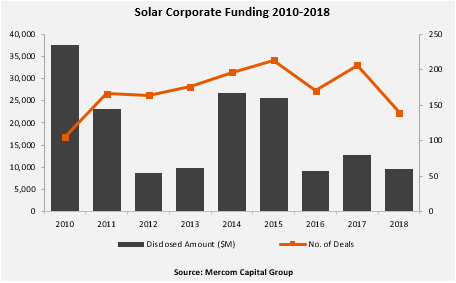

Total global corporate funding into the solar sector – including venture capital and private equity, debt financing, and public market financing – came to $9.7 billion in 2018, representing a 24% drop compared to the $12.8 billion raised in 2017. The findings are from Mercom Capital Group’s annual report on funding and mergers and acquisition activity for the solar sector.

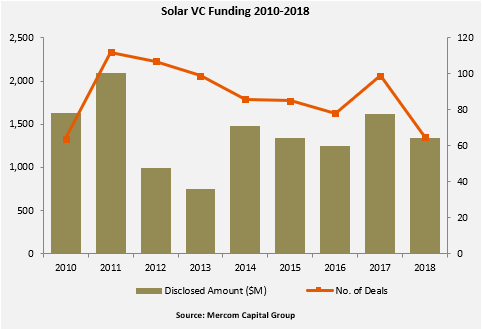

According to the report, global VC funding for the solar sector in 2018 fell 18% to $1.3 billion in 65 deals, compared to $1.6 billion raised in 99 deals in 2017.

Of the $1.3 billion in VC funding raised in 65 deals in 2018, $1.2 billion went to 50 solar downstream companies, which comprised 91% of the total VC funding in 2018.

VC funding into PV technology companies came to $37 million, and service providers raised $28 million. Investments into balance-of-system companies totaled $25 million, followed by thin-film companies with $25 million and concentrator photovoltaics companies with $2.4 million.

“2018 was a year filled with uncertainties, which started with Section 201 tariffs, followed by an announcement from China that it was capping installations and reducing its feed-in-tariff,” comments Raj Prabhu, CEO and co-founder of Mercom Capital Group. “More bad news came from India, which imposed safeguard duties on imports. Uncertainty stemming from the three largest solar markets in the world was reflected in equities of publicly traded solar companies as well as fundraising activity during the year.”

The top VC-funded companies in 2018 were Cypress Creek Renewables, which raised $200 million, followed by GreenYellow with $174 million and Amp Solar with $154 million. Wunder Capital raised $112 million, and Sunnova Energy raised $100 million.

There were 87 VC/PE investors that participated in funding deals in 2018, with four involved in multiple rounds: Box Group, Energias de Portugal, GAIA Impact Fund and New Energy Capital Partners.

Further, according to the report, public market financing increased in 2018 to $2.3 billion, raised in 21 deals, from $1.7 billion raised in 33 deals in 2017.

In 2018, announced debt financing fell 36% with $6 billion in 53 deals, compared to $9.5 billion raised in 74 deals during 2017. There were five securitization deals totaling $1.4 billion, slightly higher than the $1.3 billion in 2017, says Mercom.

Large-scale project funding announced in 2018 came to $14 billion in 182 deals, similar to the $14 billion raised in 167 deals in 2017. A total of 182 investors funded about 15 GW of large-scale solar projects in 2018 compared to 20.5 GW funded by 161 investors in 2017.

The top investors in large-scale projects included the European Bank for Reconstruction and Development, which invested in 16 projects, followed by the Dutch development bank FMO with seven deals, and Natixis with six deals.

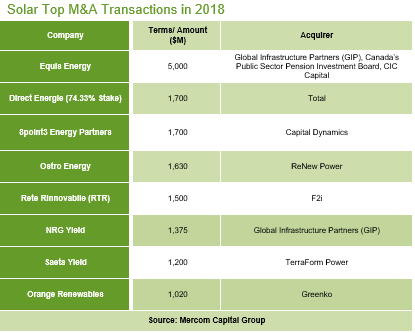

According to the report, M&A activity in the solar sector increased with 82 transactions in 2018 compared to 72 transactions in 2017. In total, 60% of the transactions involved solar downstream companies, with 49. Engie acquired four companies, while AlsoEnergy was involved in three M&A transactions. Global Infrastructure Partners, Shell and F2i acquired two companies each. Mercom says the largest and most notable transaction in 2018 was the $5 billion acquisition of Equis Energy by Global Infrastructure Partners, through its Global Infrastructure Partners III Fund along with Canada’s Public Sector Pension Investment Board and CIC Capital.

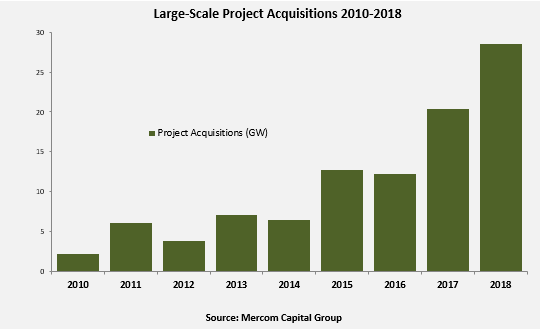

Notably, the solar sector set a record in 2018 for project acquisitions with 29 GW compared to the 20.4 GW in 2017, the report notes. There were 218 large-scale solar project acquisitions (54 disclosed for $8.4 billion) in 2018 compared to 228 transactions (92 disclosed for $8.3 billion) in 2017.

“About 100 GW of large-scale projects have been acquired since 2010 – a reflection of how far solar has come as an asset class,” adds Prabhu. “Quality solar projects are now a mature, attractive investment opportunity around the world.”

More on Mercom’s report can be found here.