Despite looming policy uncertainty in the U.S. and Europe, corporations signed a record volume of clean energy power purchase agreements (PPAs) globally in 2017, according to a new report from Bloomberg New Energy Finance(BNEF).

The increase in activity was driven by sustainability initiatives and the increasing cost-competitiveness of renewables, says BNEF.

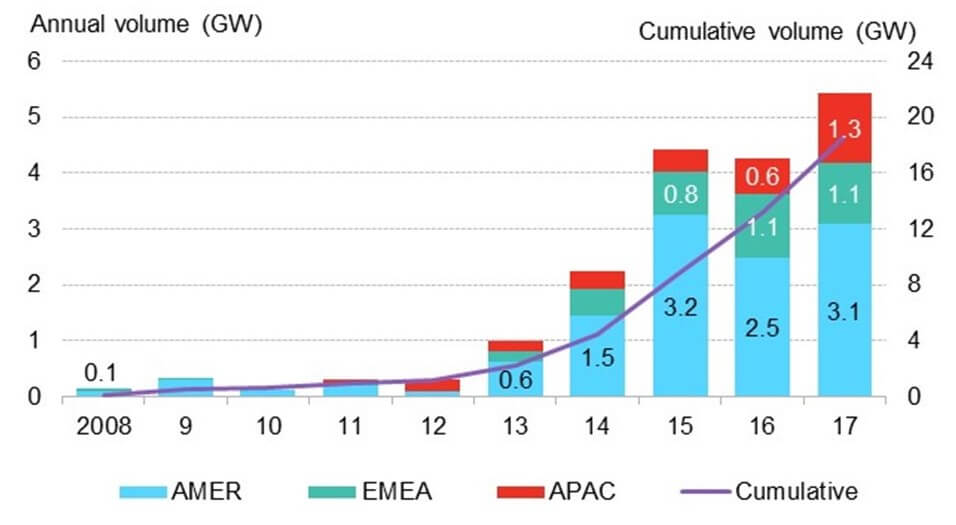

A total of 5.4 GW of clean energy contracts were signed by 43 corporations in 10 different countries in 2017, according to BNEF’s inaugural Corporate Energy Market Outlook. This was up from 4.3 GW in 2016 and a previous record of 4.4 GW in 2015. Notably, the record number was achieved despite question marks about how evolving policy could affect corporate procurement in the U.S. and Europe, the two largest markets, says BNEF.

Since 2008, corporations have signed contracts to purchase nearly 19 GW of clean power – an amount comparable to the generation capacity of Portugal. The report notes that 76% of this activity has happened since 2015.

Global corporate PPA volumes

In 2017, most of the activity occurred in the U.S., where 2.8 GW of PPAs were signed by corporations – up 19% from 2016. The most notable of these deals was Apple’s 200 MW PPA with NV Energy to purchase electricity from the Techren Solar project, representing the largest agreement ever signed in the U.S. between a corporation and a utility, says BNEF.

Europe also experienced a near-record year: With over 1 GW signed, some 95% of this volume came from projects in the Netherlands, Norway and Sweden. In those countries, policy mechanisms allow developers to secure subsidies and give corporations the ability to receive certificates to meet sustainability targets, says BNEF. The largest deal was aluminum producer Norsk Hydro’s commitment to purchase most of the electricity from the 650 MW Markbygden Ett wind farm in Sweden from 2021 to 2039. Emerging markets also saw newfound activity: The first on-site corporate PPAs were signed in Burkina Faso, Eritrea, Egypt, Ghana, Namibia, Panama and Thailand.

According to the report, activity in the U.S. persists in spite of a “tumultuous political climate” and cheap wholesale power. On Monday, the Trump administration made a landmark decision on the import of solar photovoltaic modules: The administration approved applying import tariffs on crystalline silicon photovoltaic cells and modules starting at 30%, with an annual exemption for the first 2.5 GW of imported solar cells. Although BNEF issued its report prior to this announcement, the firm says the lack of clarity on the severity of this tariff means developers cannot accurately price PPAs with corporations and other off-takers.

In Europe, the EU Winter Package is expected to make it so that developers that receive renewable energy subsidies will no longer be eligible to receive certificates; instead, they will have to acquire them through a mandatory auction. If enforced, the policy could affect the economic calculations for corporations interested in purchasing clean energy, BNEF warns.

“The growth in corporate procurement, despite political and economic barriers, demonstrates the importance of environmental, social and governance issues for companies,” states Kyle Harrison, a corporate energy strategy analyst for BNEF. “Sustainability and acting sustainably in many instances are even more important for the largest corporate clean energy buyers around the world than any savings made on the cost of electricity.”

BNEF expects volumes to grow further in 2018, surpassing 2017’s record level of activity. Commitments on the part of companies to use renewable electricity, including those made via the RE100 campaign, remain the most promising source of demand, according to the firm.

Latin America and Asia are two historically sluggish corporate procurement markets that are expected to attract major activity in 2018 and the coming years, BNEF predicts. In Mexico, private companies can now sign bilateral PPAs with developers, and major power buyers will also be expected to comply with clean energy mandates once a new certificate market kicks off this year. Large consumers in Argentina are now eligible to purchase clean energy directly from developers, rather than just the national utility.

In Asia, most of the 3.2 GW of off-site PPA contracts signed since 2008 have been in India. Cheap renewable energy resulting from competitive auctions, coupled with an unreliable grid, has prompted numerous Indian and multinational corporates to sign PPAs, despite the fact that only three Indian firms are formally a part of the RE100 campaign, the report notes.

In Australia, where corporations signed PPAs for over 400 MW in 2017, expensive wholesale power and the availability of renewable energy certificates have increased the economic incentive for locking into relatively cheap renewable electricity prices long-term.

Japan and China, however, continue to have few corporate procurement opportunities due to regulatory barriers, though both are undergoing power market reforms that will change things rapidly, says BNEF. In China, firms have built an estimated 7 GW of solar projects for on-site self-consumption since 2010, taking advantage of low costs and generous net-metering subsidies. Most of these projects are owned by a third party and have a long-term PPA with an off-taker, the report notes.

“Most companies in Asia currently are unfamiliar with the concept of corporate procurement – of the 119 RE100 members, only eight are headquartered in this region,” says Justin Wu, head of Asia-Pacific for BNEF. “But this is all about to change as multinational corporations extend their sustainability pledges to their Asia-based supply chains and their Asian competitors begin to see the need to follow suit. It won’t be long before Asian companies try to take advantage of the large amounts of renewable energy already deployed in their home markets.”