In a new ruling that largely affirms its preliminary decision made in May, the U.S. Department of Commerce (DOC) has announced its final decision on tariffs to be imposed on solar products imported from China.

In a new ruling that largely affirms its preliminary decision made in May, the U.S. Department of Commerce (DOC) has announced its final decision on tariffs to be imposed on solar products imported from China.

The DOC launched its anti-dumping and countervailing-duty investigations last October, after SolarWorld and its partners in the Coalition for American Solar Manufacturing (CASM) filed a complaint alleging that low-cost, subsidized Chinese imports were harming the U.S. solar manufacturing industry.

‘Commerce determined that Chinese producers/exporters have sold solar cells in the United States at dumping margins ranging from 18.32 percent to 249.96 percent,’ the department wrote in a fact sheet describing its findings. ‘Commerce also determined that Chinese producers/exporters have received countervailable subsidies of 14.78 percent to 15.97 percent.’

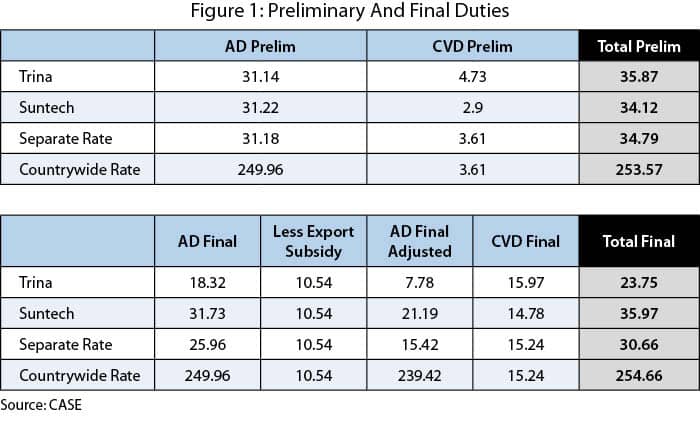

These findings translate into tariffs – of varying severity – for all Chinese producers and exporters. Mandatory respondents Suntech and Trina received individual evaluations: Suntech was found to have a final dumping margin of 31.73% and a final net subsidy rate of 14.78%. Trina was found to have a final dumping margin of 18.32% and a final net subsidy rate of 15.97%.

Fifty-nine other companies – including JA Solar, JinkoSolar and other well-known names in the industry – received a dumping margin of 25.96%; the rate for remaining Chinese companies was significantly higher, at 249.96%.

The final tariff math is complicated by the application of a 10.54% reduction to companies' anti-dumping rates. This reduction is put in place to avoid double counting of anti-subsidy tariffs, according to the Coalition for Affordable Solar Energy (CASE), which released a chart explaining the ultimate effect. (See figure below.)

Additionally, more than 12 categories of Chinese subsidy programs were deemed by the DOC to be illegal, the CASM says. The DOC also found that ‘critical circumstances’ exist in the countervailing-duty investigation, which will make most of the tariffs retroactive 90 days from the DOC's May announcement. CASM had petitioned for a critical-circumstances determination.

However, the CASM's efforts to expand the investigation beyond Chinese solar cells were unsuccessful; PV modules produced in China from cells manufactured in third countries will not be subject to tariffs.

CASM member Helios Solar Works says it is ‘disappointed that the scope did not include modules and laminates,’ CEO Steven Ostrenga tells Solar Industry. ‘China has been illegally exporting [not only] the solar cell, but also the entire module.’

According to the CASM, the DOC's decision to exclude Chinese modules using third-country cells leaves a major loophole, providing an opportunity for manufacturers to circumvent duties.

‘This will undercut the positive impact of Commerce's duties,’ warned Gordon Brinser, president of SolarWorld Industries America Inc., in a statement. Ostrenga says that the ‘loophole’ also makes enforcement of existing trade remedies more difficult.

SolarWorld and its partners now plan to seek separate enforcement actions on Chinese modules assembled from third-country cells, as well as work with members of Congress to find a legislative method to close off this potential avenue of tariff circumvention. One possibility is to add additional countries to the list of exporters subject to tariffs, according to Ostrenga.

Time for talks?

The industry's anti-tariff contingent, led by Chinese manufacturers and the CASE, reacted to the DOC's announcement with reluctant acceptance, as well as relief that the final tariff rates did not jump significantly from the numbers released by the DOC in May.

‘It's unfortunate that the process works this way,’ said E.L. McDaniel, managing director of Suntech America, in a statement criticizing unilateral trade barriers as ineffective and destructive.

Alan King, general manager of U.S. operations for Canadian Solar, similarly criticized the U.S. government's decision. ‘Any obstacles that are put in the way of free trade among nations [are] counter-productive,’ he tells Solar Industry. ‘If the U.S. wants a level playing field, it should put more effort into supporting its industries and less time erecting barriers against other nations.’

Hoil Kim, vice president and chief administrative officer for equipment supplier GT Advanced Technologies (a member of CASE), says the tariffs offer no benefit to the vast majority of the U.S.' solar sector.

‘The bulk of the industry is companies like us, providing equipment and raw materials to the solar sector, and then installers and end users of modules,’ Kim tells Solar Industry. ‘There's not a lot in between – that's a very small portion of the solar industry in the U.S.’

The CASM, for its part, claims than more than 85% of its 225 members are ‘downstream operators,’ including financiers and installers.

The Solar Energy Industries Association (SEIA), which counts upstream and downstream – and pro-tariff and anti-tariff – companies among its members, called once again for diplomatic talks.

‘Trade litigation alone is not enough to solve the complex challenges that exist between the U.S. and China,’ said Rhone Resch, president and CEO of SEIA, in a statement. Prior to the CASM's petition, the U.S. and Chinese solar sectors successfully worked together, he added.

Now that the DOC has issued its final ruling, the only step remaining in the year-long investigation is the final determination from the International Trade Commission (ITC), expected by Nov. 23. The ITC is tasked with determining whether imports of solar cells from China ‘injure, or threaten material injury to, the domestic industry,’ the DOC explains in its fact sheet.

If the ITC concludes that injury is taking place, the tariffs will go forward; if not, the investigations will end. At least one manufacturer – Trina Solar – has indicated that if the ITC makes an affirmative determination, it may appeal the tariff decisions.

Last December, the ITC announced that its preliminary investigations revealed that Chinese imports were, in fact, harming the U.S. industry. Reversals of preliminary decisions are generally rare, according to Kim.

‘The only way this can go on a different track is for the governments to talk directly,’ he says. ‘The Chinese government would have to initiate that process. We firmly believe, as do our fellow members of the [CASE], that that's the right solution for the situation. But the U.S. has not indicated any receptivity.’