The U.S. energy transition will continue apace into 2022 with record levels of solar and wind generation additions expected to come online, according to the newly released 2022 Electric, Natural Gas and Water Utilities Outlook Report from S&P Global Market Intelligence.

The report finds that as this buildout occurs, utilities and the wider energy industry continue to find ways to finance, build and operate the necessary infrastructure to support these assets and address those that get left behind.

Published by S&P Global Market Intelligence’s Energy Research team, the report spotlights trends in renewable energy growth, grid transformation, utility regulation and capital expenditure expansion.

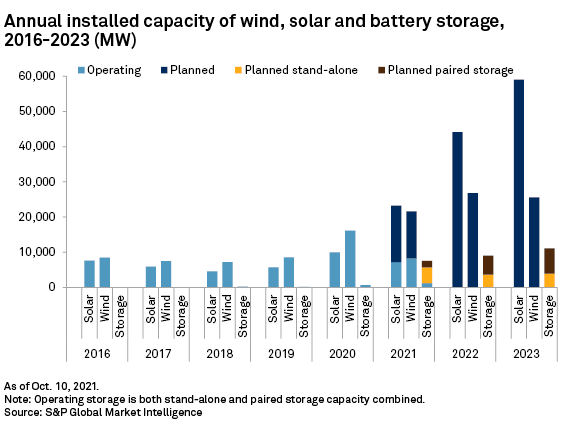

“It’s going to be a record year for renewable energy development in the U.S. in 2022, with 44 GW of solar and 27 GW of wind power set to be installed alongside more than 8 GW of battery storage,” explains Richard Sansom, head of commodities research at S&P Global Market Intelligence. “As the momentum of the energy transition continues to build, this report looks at how regulators and utilities are adapting to state and federal carbon reduction policies and dealing with the costs of the assets that get left behind.”

As much as 44 GW of solar and 27 GW of wind is planned to be installed in 2022 along with over 8 GW of battery storage, facilitated by the creation of dedicated programs such as virtual power purchase agreements and green tariffs.

Early plant retirement costs due to the energy transition will present challenges for utilities and state regulators with 29 GW of coal retirements planned for 2020 through 2025.

U.S. utility capex is expected to remain on the upswing, with investments in upgrading and modernizing the country’s aging energy and water infrastructure reaching $63 billion and utility renewables spending surpassing $14 billion in 2022.

With the U.S. economy challenged by fallout from the COVID-19 pandemic, the averages of the state-authorized electric, gas and water utility ROEs fell to their lowest levels on record in 2020 and are likely to remain near that level for 2021 and 2022, despite potential rising interest rates and the spectre of inflation.

Water and wastewater utility M&A has increased in 2021, and is expected to accelerate in 2022, as investor-owned companies target municipal system acquisition targets.

The S&P Global Market Intelligence 2022 Electric, Natural Gas and Water Utilities Outlook Report is part of a “Big Picture Outlook” series published by the division’s research group that provides a look ahead of key strategic trends and opportunities.