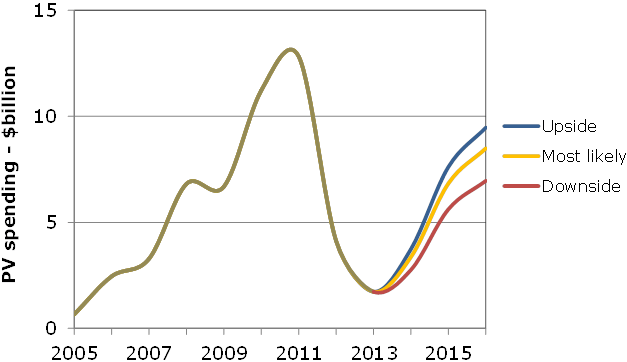

According to a new report from NPD Solarbuzz, solar photovoltaic manufacturing equipment suppliers have rounded the bottom of the industry's slump and are forecast to embark on an upturn in 2015. A rosy scenario sees capital spending in the solar manufacturing sector reaching $10 billion in 2017.

According to a new report from NPD Solarbuzz, solar photovoltaic manufacturing equipment suppliers have rounded the bottom of the industry's slump and are forecast to embark on an upturn in 2015. A rosy scenario sees capital spending in the solar manufacturing sector reaching $10 billion in 2017.

For 2013, PV equipment revenues spending from makers of crystalline silicon (c-Si) ingots, wafers, cells, modules and thin-film panels declined to an eight-year low of $1.73 billion, NPD Solarbuzz says, a precipitous drop from 2011's heights of approximately $13 billion. PV equipment suppliers recorded less than $1 billion of net bookings last year, the report says, keeping the PV book-to-bill ratio well below parity. In the absence of new PV orders, many equipment suppliers were forced to restructure internal PV business units and focus on other technology sectors.

Source: NPD Solarbuzz PV Equipment Quarterly

‘During 2012 and 2013, solar PV equipment suppliers were confronted by the sharpest downturn ever to hit the sector,’ says Finlay Colville, vice president at NPD Solarbuzz. ‘The decline was caused by strong over-capacity that reshaped the entire PV industry in 2012, which resulted in manufacturers' capital expenditure budgets being put on hold during 2013.’

Over the next six months, the report says, end-market solar PV demand will catch up with the 45 GW of effective manufacturing capacity within the industry. Thereafter, plans will quickly emerge from PV manufacturers for new capacity additions, NPD Solarbuzz says. The next major growth phase for PV equipment suppliers will be driven mainly by leading tier-one PV manufacturers across each stage of the PV value chain, the report forecasts.

Initially, these additions will be motivated by economy-of-scale benefits in cost reduction and productivity, NPD Solarbuzz says. Thereafter, technology-driven spending, historically of minimal upside revenue potential to PV equipment suppliers, will gradually be phased in, as PV cell efficiencies approaching 20% become the industry standard.

With c-Si-based solar PV modules retaining a market share above 90%, new capacity expansions from c-Si PV manufacturers will dominate the PV equipment spending upturn beginning in 2015. However, NPD Solarbuzz says the competing thin-film segment will continue to offer revenue potential for the equipment supply chain.

More information about the latest NPD Solarbuzz PV equipment report can be found here.