According to the U.S. Solar Market Insight 2019 Year-in-Review report, released by the Solar Energy Industries Association (SEIA) and Wood Mackenzie, solar accounted for 40% of all new electric generating capacity in the U.S. in 2019, its highest share ever and more than any other source of electricity, with 13.3 GW installed.

Despite policy challenges and a second year of the Section 201 tariffs, the U.S. solar market grew by 23% from 2018.

“Even as tariffs have slowed our growth, we’ve always said that the solar industry is resilient, and this report demonstrates that,” says Abigail Ross Hopper, president and CEO of SEIA.

“We know anecdotally that the COVID-19 pandemic is starting to impact delivery schedules and that it could affect demand for solar as well as our ability to meet project completion deadlines based partly on new labor shortages. This once again is testing our industry’s resilience, but we believe, over the long run, we are well-positioned to outcompete incumbent generators in the Solar+ Decade and to continue growing our market share,” she adds.

The residential solar sector saw record-setting installation totals, with more than 2.8 GW installed, led by a record year in California and continued growth in emerging markets. The segment saw an annual growth of 15% while achieving its highest installation volumes in history.

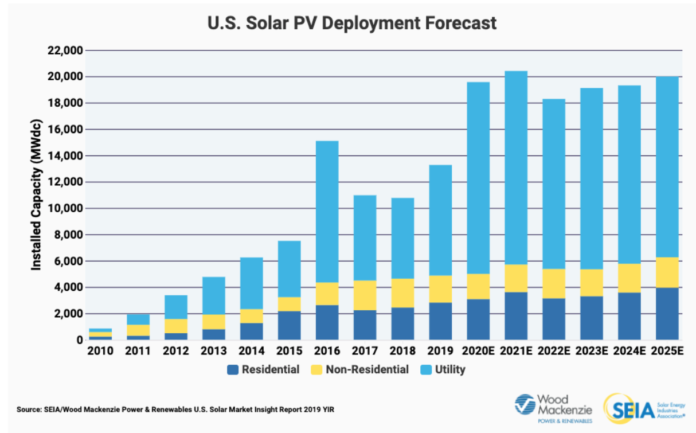

According to the report, the total installed PV capacity in the U.S. is projected to rise by 47% in 2020, with nearly 20 GW of new installations expected by the end of the year. Each of the next two years are expected to be the largest on record for the U.S. solar industry.

Over the next five years, the total installed U.S. PV capacity will more than double, with annual installations reaching 20.4 GW in 2021 prior to the expiration of the federal solar Investment Tax Credit for residential systems and a drop to 10% for commercial and utility-scale customers.

Wood Mackenzie’s solar team is tracking industry changes closely as they relate to solar equipment supply chains, component pricing and project development timelines, and their organizations will issue follow-up reports on the impacts of the pandemic as needed, notes the company.

Photo: U.S. Solar PV Deployment Forecast from the ‘U.S. Solar Market Insight 2019 Year-in-Review’ report