Supply chain constraints are leading to price increases across every solar market segment, despite the addition of 5.7 GW DC of solar capacity in Q2 2021, according to the U.S. Solar Market Insight report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie, a Verisk business.

This is the first time that solar prices have increased quarter-over-quarter and year-over-year in every market segment since Wood Mackenzie began modeling system price data in 2014. Prices increased the most for the utility-scale segment at about 6% year-over-year. Many solar developers have sufficient inventory for 2021 projects but will begin to see price increases in 2022, the report says.

“This is a critical moment for our climate future but price increases, supply chain disruptions and a series of trade risks are threatening our ability to decarbonize the electric grid,” says SEIA president and CEO Abigail Ross Hopper. “If we want to incentivize domestic manufacturing and drive enough solar deployment to tackle the climate crisis, we must see action from our federal leaders.”

In addition to recent enforcement actions on Xinjiang metallurgical grade silicon, two new tariff petitions have been filed. Taken together, these actions could significantly exacerbate supply chain constraints and increase solar system prices.

Despite these near-term headwinds, the solar industry accounted for 56% of all new U.S. electric capacity additions in the first half of 2021. The U.S. officially surpassed 3 million solar installations in Q2, driven by a strong recovery in the residential sector after it was hit by the COVID-19 pandemic.

“The solar industry continues to demonstrate strong quarterly growth, and demand is high across every segment,” states Michelle Davis, principal analyst at Wood Mackenzie and lead author of the report. “But the industry is now bumping up against multiple challenges, from elevated equipment prices to complex interconnection processes. Addressing these challenges will be critical to expanding the industry’s growth and meeting clean energy targets.”

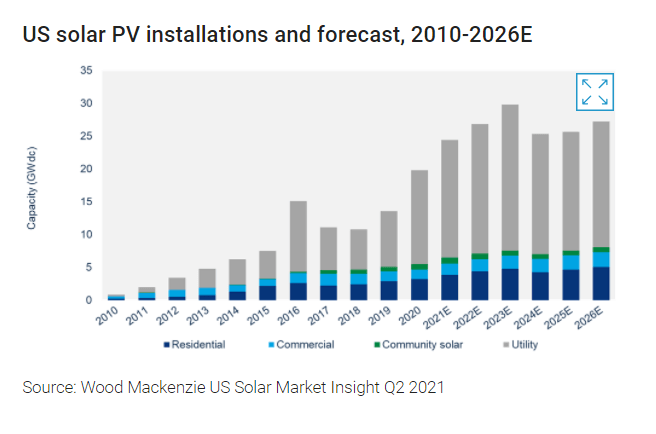

New forecasts from Wood Mackenzie show that the U.S. will average just over 29 GW of new annual solar capacity additions through 2026. But this is far short of the deployment pace needed to reach President Biden’s 2035 clean energy targets. To reach these targets, the solar industry must install more than 80 GW of solar annually from 2022 through 2035.

The solar industry will continue to set annual installation records until the solar Investment Tax Credit fully phases down in 2024. Industry growth is expected to flatline in 2025 and 2026. These forecasts do not account for additional trade actions, which represent a substantial downside risk to Wood Mackenzie’s outlooks.

Residential solar was up 2% over Q1 2021, but up 46% from Q2 2020 when installations were hit hardest by the Covid-19 pandemic. With 974 MW DC installed, volumes were on par with Q4 2020. Community solar was up 16% over Q2 2020 with 177 MW DC installed, and commercial solar was up 31% over the same quarter last year with 354 MW DC installed.

Utility-scale solar set another record for second-quarter installations at 4.2 GW DC. Texas, Arizona, and Florida accounted for nearly 3 GW of the quarterly total. A total of 9.3 GW DC of new utility-scale solar power purchase agreements were signed in Q2 2021, bringing the utility-scale contracted pipeline to nearly 85 GW DC.