Standard Solar Inc., a company that specializes in the development, funding, ownership and operation of commercial and community solar assets, in a partnership with Crestmark, a division of MetaBank N.A., has expanded its portfolio with the tax equity financing and operation of 17 community solar projects – totaling 24.6 MW – in Minnesota and Massachusetts.

Sixteen of the community solar projects are in Minnesota and all have achieved operation. Minnesota’s community solar program provides a comprehensive approach that makes developing community solar projects economically viable. The projects are expected to generate 3.89 million kWh of solar power yearly for customers under long-term contracts.

The 2.8 MW project in Massachusetts is expected to be completed this month and will move the state closer to achieving its renewable portfolio standard of 35% by 2030. Community solar is one of the fastest-growing sources of renewable energy in Massachusetts.

“We are pleased with the strong relationship we have established with Crestmark to successfully build and finance this portfolio,” says Peter Coleman, senior vice president of structured finance at Standard Solar. “Despite challenges created by COVID-19, we have worked collaboratively with our strongest development and financial partners to successfully excel the business during the most challenging times.”

Community solar is an effective way to provide large numbers of subscribers access to the benefits of clean energy, advance the clean energy workforce and economic impact, and drive millions of dollars of investment in the state in which the projects are located.

With the addition of these projects, Standard Solar’s portfolio of community solar projects funded and operating with partners around the U.S. is in excess of 175 MW. Massachusetts and Minnesota account for about half of the cumulative capacity of community solar throughout the U.S. according to the National Renewable Energy Laboratory.

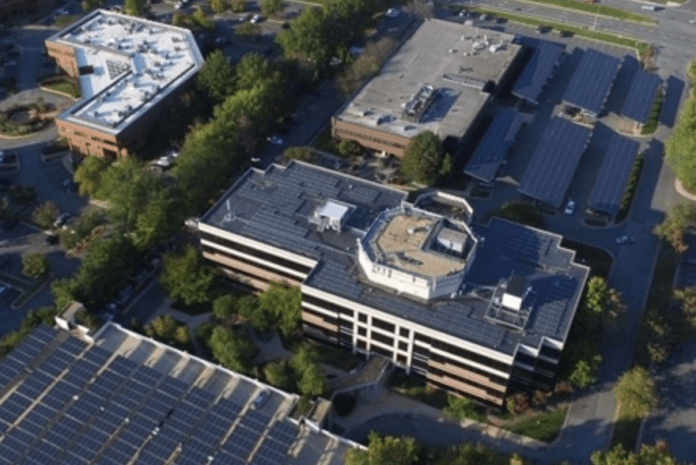

Photo: Standard Solar’s landing page