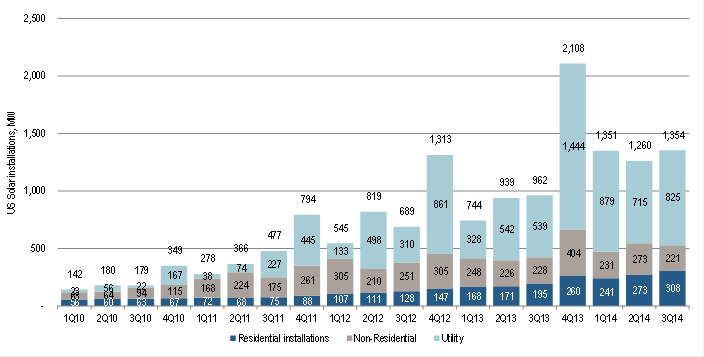

The U.S. has installed 1,354 MW of solar photovoltaic power systems in the third quarter of this year (Q3'14), up 41% over the same period last year, says new analysis from GTM Research and the Solar Energy Industries Association (SEIA).

According to the report, Q3'14 was the nation's second-largest quarter for PV installations and brings the cumulative U.S. solar PV capacity to 16.1 GW, with another 1.4 GW of concentrating solar power capacity. Through the first three quarters of the year, solar represents 36% of new electricity generation capacity to come online, up from 29% in 2013 and 9.6% in 2012.

The report tracks installations across three market segments: utility-scale, residential and non-residential, which includes commercial, government and nonprofit installations.

Historically, the U.S. utility-scale market segment has accounted for the majority of PV installations, and this past quarter continued the trend. The U.S. installed 825 MW of utility-scale projects, up from 540 MW in the third quarter of 2013 (Q3'13). This marks the sixth straight quarter in which utility-scale PV has accounted for more than 50% of the national total.

The U.S. residential market has exceeded 300 MW in a quarter for the first time. GTM Research forecasts it will exceed the non-residential segment in annual installations for the first time in more than a decade. Residential installations have grown in 18 out of the past 19 quarters.

The non-residential market continues to struggle, the report says, due in part to incentive depletion in California and Arizona. Installations in the segment were down 3% in Q3'14 from Q3'13. However, GTM Research and SEIA expect year-over-year growth for the non-residential market.

The report forecasts the U.S. to install 6.5 GW of PV in 2014, a 36% increase over 2013.

‘Solar's continued, impressive growth is due, in large part, to smart and effective public policies, such as the solar investment tax credit (ITC), net-energy metering and renewable portfolio standards,’ says Rhone Resch, SEIA president and CEO.

Many industry observers expect a significant downturn in utility- and large-scale solar installations with the expiration of the federal ITC at the end of 2016. It is an open question whether growth in other market segments will be able to compensate for the anticipated drop-off after the ITC expires in terms of maintaining an overall trend in U.S. PV growth.

More information about the ‘U.S. Solar Market Insight’ report can be found here.

Source: GTM Research/SEIA