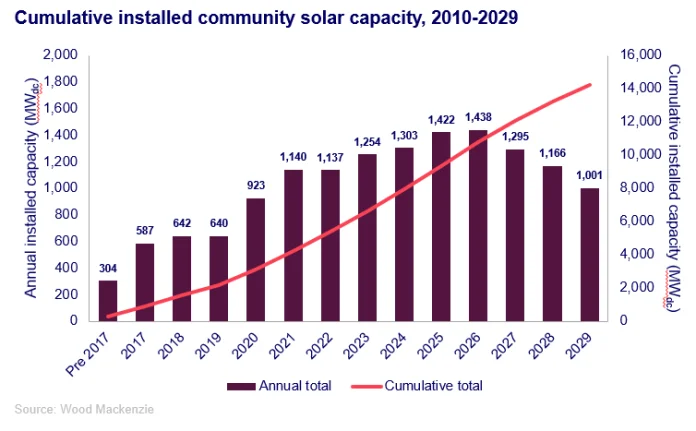

New domestic community solar installations are expected to reach 7.3 GW in existing state markets by 2029, according to the latest report released by Wood Mackenzie and the Coalition for Community Solar Access (CCSA).

Cumulative national community solar installations will break 14 GW by the same year.

Program pipelines remain strong in mature state markets, for now. Wood Mackenzie forecasts the national community solar market to grow at an average annual 5% rate through 2026 and then contract by 11% on average through 2029. Expanded program capacity and establishment of new state markets have the potential to add further uplift beyond 2026.

Under a bull case forecast scenario, Wood Mackenzie’s five-year outlook increases by 21% in existing markets compared to the base case, while there is a 20% decrease under a bear case. Alternative scenarios do not account for the establishment of new state markets.

Wood Mackenzie estimates that the enactment of proposed legislation in Ohio, Pennsylvania, Michigan, and Wisconsin and four additional potential state markets would result in an at least 17% uplift from the base case. When considering a bull case forecast scenario for existing markets and the successful passage of legislation in all potential markets, the cumulative national outlook reaches 17.1 GW by 2029.

According to the report, 3.6 GW of community solar is expected to serve low-to-moderate income subscribers by 2029. As of this year’s first quarter, Wood Mackenzie estimates that 829 MW of community solar directly serves LMI subscribers.

“The U.S. community solar market has tripled in size since 2020, but growth is beginning to slow in existing state markets,” says Caitlin Connolly, senior research analyst at Wood Mackenzie and lead author of the report.

“Additionally, the May 2024 decision on California community solar resulted in a significant 14% reduction to Wood Mackenzie’s five-year national outlook. Without a major market entrant like California, long-term community solar growth will largely depend on the enactment of legislation to enable new state markets.”

Moreover, the top three subscriber management companies manage 56% of the total community solar subscribers and 71% of LMI subscribers. LMI subscribers remain the most costly to acquire with costs averaging $113 per kilowatt, 27% higher than the average cost to require non-LMI residential subscribers. Developers can save on costs by outsourcing subscriber acquisition and management to third-party companies, stated the report.