As solar energy development continues to expand in the Southeast – with projections for future growth higher than last year’s forecast – the growth patterns remain varied from state to state, according to a new report from Southern Alliance for Clean Energy (SACE).

The Solar in the Southeast 2018 Annual Report highlights solar data and trends throughout the region through 2018. North Carolina leads for solar capacity with 3,266 MW, followed by Florida with 1,622 MW, Georgia with 1,419 MW and South Carolina with 1,116 MW. At the bottom of the list are Tennessee with 272 MW, Mississippi with 187 MW and Alabama with 153 MW.

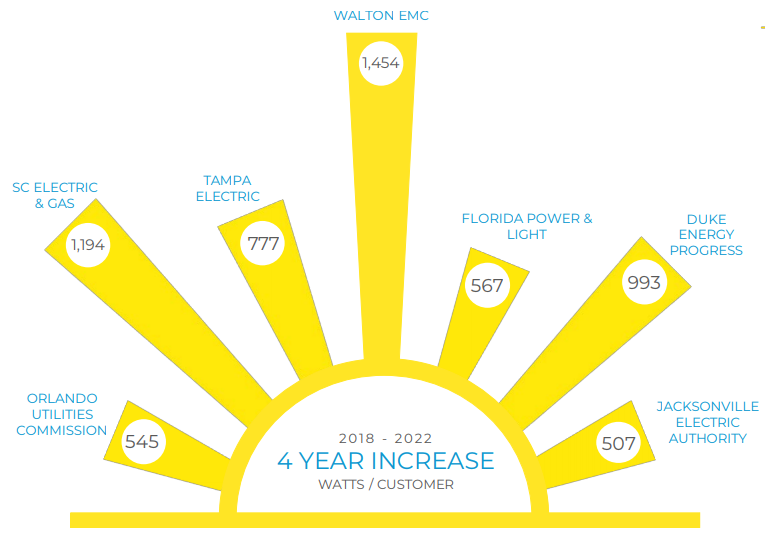

Using the metric “watts per customer” (W/C), which looks at the amount of installed solar relative to the total number of customers served, SACE offers an analysis with information at the regional, state and utility level.

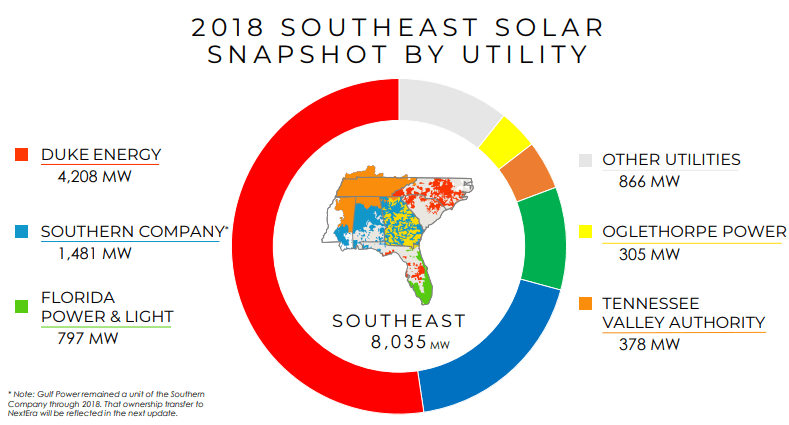

According to the report, the Southeast exceeded 8,000 MW of solar capacity in 2018 and is expected to comfortably surpass 10,000 MW in 2019. SACE has increased its forecast to 17,000 MW by 2021 and close to 20,000 MW for 2022.

Of the utilities, Duke Energy leads with 4,208 MW, followed by Southern Co. with 1,481 MW and Florida Power & Light with 797 MW. (The report notes that Gulf Power remained a Southern Co. unit through 2018, so the ownership transfer to NextEra will be reflected in SACE’s next update.) In addition, Oglethorpe Power has 305 MW, Tennessee Valley Authority (TVA) has 378 MW and other utilities have 866 MW.

The report notes that corporate leadership is playing a big role in driving new solar capacity: Facebook drove big solar commitments in Georgia (203 MW), Alabama (227 MW) and Tennessee (150 MW), and Google announced projects for Tennessee and Alabama (150 MW each) and joined with Target, Walmart and Johnson & Johnson to contract with Georgia Power for 177 MW.

On a state-by-state basis, Florida is emerging as a regional leader; it is now forecast to surpass the current leader, North Carolina, in solar capacity by 2022. Florida is also seeing a surge in residential and commercial-scale solar, thanks in part to continued strong net metering policies throughout the state and the approval of several new solar leasing programs by the Florida Public Service Commission, the report says.

On the other hand, Tennessee and Alabama continue to lag behind other states in the Southeast. For Tennessee in particular, its current and projected solar capacity remains at less than half that of its regional counterparts. The report also points to flaws in TVA’s solar plans.

“Tennessee Valley Authority was an early regional leader in small-scale, distributed solar,” comments Dr. Stephen A. Smith, executive director of SACE. “Now, TVA is hostile to solar development and appears only willing to work with large corporations such as Facebook and Google, as opposed to playing a leadership role in bringing solar opportunities to all customers. TVA has the chance to regain their reputation as an innovative leader by taking advantage of the solar potential in their region, and yet it continues to fall behind.”

The report claims that TVA has also taken steps to actively discourage residential and commercial-scale solar by reducing the rate it pays for solar to below retail and announcing the cancelation of its Green Power Providers Program at the end of 2019.

In addition to TVA, the report names “SunBlockers” as Santee Cooper in South Carolina, North Carolina Electric Cooperatives and Seminole Electric Cooperative in Florida. SACE projects that solar W/C for these four utilities will remain below today’s regional average W/C through at least 2022.

As for “SunRisers,” there are new entrants on the leaderboard: Walton EMC in Georgia, Florida Power & Light and Orlando Utilities Commission in Florida, which join four returning SunRisers, SCE&G in South Carolina, Duke Energy Progress in North Carolina, Tampa Electric in Florida and Jacksonville Electric Authority in Florida.

“This analysis in our second regional solar report shines a light on the utilities and states that excel in smart solar growth and demonstrates the enormous potential that remains in the Southeast for increased solar development,” adds Smith. “Using the unbiased ‘watts per customer’ metric, we are also able to see which states and utilities are continuing to fall behind and need a serious course correction to avoid denying customers the economic and environmental benefits of clean solar power. We hope that the facts presented in this report will continue to serve as a helpful tool as utilities and regulators throughout the region advance in their renewable energy planning.”

The full report can be read here.