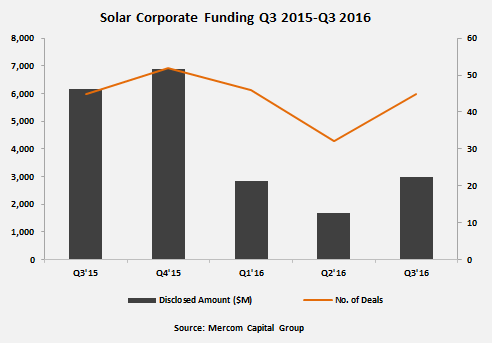

After hitting a three-year low last quarter, total corporate funding in the global solar sector slightly rebounded during the third quarter of this year (Q3’16), according to a new report from Mercom Capital Group. Nonetheless, most of the latest numbers remain far shy of what the industry saw in 2015, as the sector continues to grapple with several challenges.

The report says total corporate funding – including venture capital (VC), public market and debt financing – into the global solar sector in Q3’16 was up to about $3 billion in 45 deals, compared with the $1.7 billion in 32 deals in Q2’16.

“Third-quarter financial activity was a mixed bag,” commented Raj Prabhu, CEO and co-founder of Mercom Capital Group, a clean energy research and communications firm. “Most areas showed improvement quarter-over-quarter, but overall funding levels are still lagging behind 2014 and 2015. VC funding held steady, and we saw a mini comeback for yieldco stocks. The market is slowly getting past the SunEdison crash but is now facing a Chinese module oversupply situation.”

He said those issues, combined with “slower-than-expected U.S. demand” and “global hyper-competitive auctions,” have impacted “the entire supply chain, and most of the solar equities are in the red year-to-date.” Notably, a host of solar sector players, including Enphase Energy, SMA, SunPower and SolarWorld, recently announced plans to streamline their businesses among such market challenges.

(It appears solar isn’t the only clean energy technology financially affected by global market issues, as a separate report from Bloomberg New Energy Finance suggests that investment in the overall cleantech industry was “worryingly low” in Q3’16.)

More solar stats

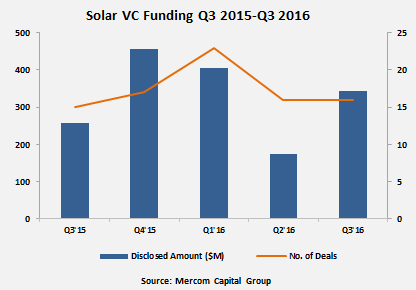

The Mercom report says that global VC funding (including private equity) for the solar sector almost doubled in Q3’16 with $342 million in 16 deals compared with the $174 million raised in the same number of deals in Q2’16.

Solar downstream companies raised $273 million in eight deals compared with $112 million in seven deals in Q2’16. The report says the largest share came from the $220 million raised by Solar Mosaic, a provider of residential solar loans, from Warburg Pincus, Core Innovation Capital and Obvious Ventures.

Other top VC deals this quarter included the $47 million raised by Heliatek, $20 million raised by BBOXX, $15 million raised by d.light, and $10 million each raised by Morgan Solar and Off-Grid Electric.

Solar public market financing in Q3’16 came to $880 million in five deals, including one initial public offering (IPO), compared with $179 million in four deals in Q2’16. In Q3’15, public market financing totaled $1.8 billion. The first solar IPO this year was recorded by BCPG, a solar downstream company for $166 million.

Debt financing came to almost $1.8 billion in 24 deals in Q3’16 compared with 12 deals in Q2’16 for $1.3 billion. Year-over-year, $4.1 billion was raised in 22 deals in Q3’15.

According to the report, the top five large-scale project funding deals in Q3’16 were the following: Magnetar Capital raised $397 million to refinance its 135 MW U.K. solar projects portfolio; Sinogreenergy raised $200 million to develop a portfolio of up to 550 MW of solar projects in Taiwan; SunPower secured a $199.7 million syndicated loan for its 100 MW Pelican Solar Project in Chile; Gunkul Engineering secured $115.8 million in a syndicated loan for the construction of the 31.75 MW Sendai Okura solar project in Japan; and Fotowatio Renewable Ventures received $103.4 million in project financing for the 50 MW solar PV project in northern Jordan.

Residential and commercial solar funds raised in Q3’16 came to $1.1 billion in five deals compared with $1.36 billion in 11 deals in Q2’16. Of the $1.1 billion announced in Q3’16, $760 million went toward leases and $333 million went to loan funds. So far this year, the report adds, close to $3.5 billion has been raised in 22 deals. During the same period last year, more than $5 billion was raised in 21 deals.

In Q3’16, there were also 18 solar merger and acquisition (M&A) transactions compared with 17 in the previous quarter. Solar downstream companies accounted for half of the transactions (nine), followed by manufacturers with five. The report says four acquisitions involved SunEdison companies this quarter as a result of the company’s filing for bankruptcy and selling off parts of its business.

There were 55 large-scale solar project acquisitions (24 disclosed for $1.3 billion) compared to Q2’16, which had 38 transactions (13 disclosed for $1.9 billion). About 2.6 GW of solar projects were acquired in Q3’16 compared with 2 GW in the previous quarter.

According to the report, the top five project acquisitions of the quarter by megawatts included the following: NextEra Energy Partners acquired a 24% stake in Desert Sunlight Investment Holdings’ 550 MW solar project in California (called Desert Sunlight Solar Energy Center) for $218 million; Solar Partnership Capital acquired 152 MW of solar projects from Sky Solar Japan for $165 million; Integrated Asset Management acquired a portfolio of 30 solar projects totaling 34 MW in Italy for $141.4 million; 8point3 Energy Partners, a yieldco company formed by First Solar and SunPower, acquired SunPower’s 49% stake in its 102 MW Henrietta Solar Project in California for $134 million; and Macquarie Group and BRUC Capital acquired a 37 MW solar project pipeline including 27 individual projects in Japan from IBC SOLAR for $101.2 million.

Mercom says it tracked 185 new large-scale project announcements worldwide in Q3’16 totaling 9.2 GW.

Looking ahead, Mercom’s Prabhu said, “We have to wait and see what direction Chinese policymakers take in terms of tariff cuts and solar installation goals, as it will have a global effect. A slower-than-expected 2016 for U.S. installers might signal a better 2017 as large-scale projects are pushed forward. Most companies relied on overly optimistic forecasts for 2016 and have had to pull back their guidance, hurting investor sentiment.

“If companies focus on profitability and manage growth expectations,” he stated, “next year could be a better year.”