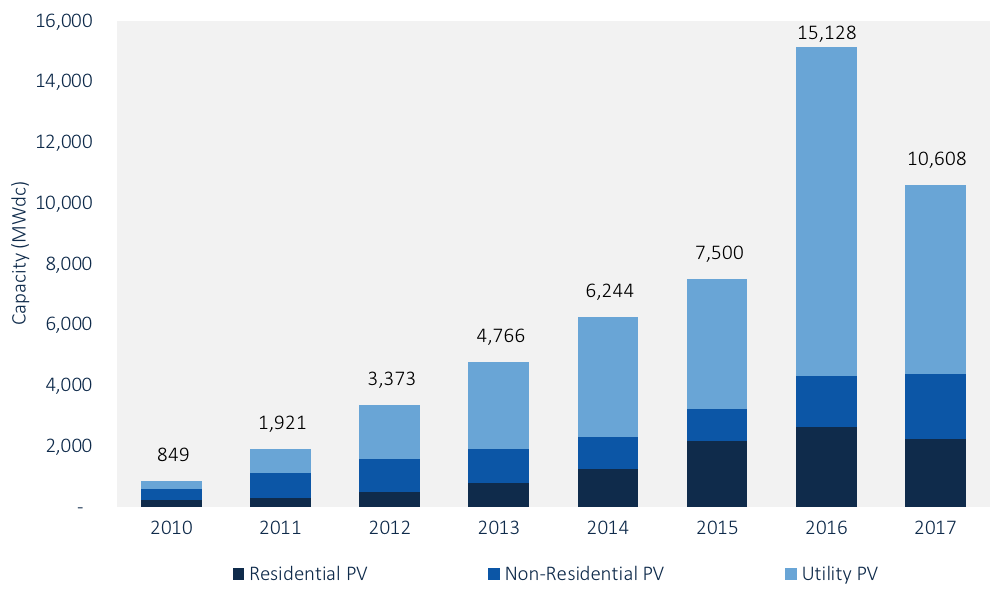

Although overall growth of the U.S. solar industry was down in 2017 compared to 2016’s record-shattering numbers, last year’s capacity additions still represent 40% growth over 2015, according to the newly released U.S. Solar Market Insight Report 2017 Year-in-Review from GTM Research and the Solar Energy Industries Association (SEIA).

In 2017, the U.S. solar market expanded, adding double-digit gigawatt solar photovoltaic additions for the second year in a row. According to the report, the solar industry installed 10.6 GW of new PV capacity in 2017, led by strong growth in the corporate and community solar segments. However, this represents a 30% decrease year-over-year from 2016.

“The solar industry delivered impressively last year despite a trade case and market adjustments,” comments Abigail Ross Hopper, president and CEO of SEIA. “Especially encouraging is the increasing geographic diversity in states deploying solar, from the Southeast to the Midwest, that led to a double-digit increase in total capacity.”

According to the report, the non-residential market segment got its moment in the spotlight in 2017: It grew 28% year-over-year, notching its fourth straight year of annual growth. Last year in particular saw an explosion in the community solar market, led by Minnesota and Massachusetts, the report says.

“Minnesota headlined a banner year for community solar, with more megawatts installed in that state than total U.S. community solar installations in all of 2016,” says Austin Perea, GTM Research solar analyst and co-author of the report. “We expect community solar to diversify geographically in 2018, with Maryland and New York to be key growth markets for the sub-segment beginning this year.”

However, the residential and utility-scale segments saw installations fall on an annual basis for the first time since GTM Research and SEIA began publishing the report in 2010.

The report says the year-over-year downturn for the utility segment in 2017 was largely expected, considering the massive influx of installations seen in 2016 as projects were rushed to completion before the anticipated expiration of the 30% federal investment tax credit. The report notes that uncertainty surrounding the Section 201 tariffs caused many projects to be postponed or canceled, while interconnection delays and PURPA cancellationcaused many projects to spill over into 2018.

Of the top 10 state markets for residential solar in 2016, only two saw annual growth in 2017. However, 25 of the 44 states tracked in the report saw year-over-year growth in annual residential PV installations, with several states climbing up in the rankings.

Florida managed to break into the top 10 states for the first time since 2011, jumping to the No. 10 spot for cumulative solar capacity installed. Over the last year, South Carolina also saw big gains, moving up nine spots in the new rankings to No. 18 in the U.S.

California and North Carolina remain the two largest solar states after adding the most and second-most capacity in 2017, respectively, the report says.

Other key findings of the report include as follows:

- In 2017, 30% of all new electric generating capacity brought online in the U.S. came from solar, ranking second during that period only to natural gas.

- In most PV market segments, the fourth quarter of 2017 saw price increases, stemming from increases in module costs. This was due to a global shortage of Tier 1 module supply and the uncertainty spurred by the Section 201 petition. However, the price increases were mitigated by falling prices in racking and inverters, improving operating efficiencies, and likely margin compression.

- The residential PV sector fell 16% from 2016. This contraction was driven by weakness in California and major Northeast markets, which continue to feel the impact of pullback from certain national installers that have shifted away from rapid-expansion strategies.

- In contrast to residential PV, the non-residential sector’s 28% growth was driven primarily by regulatory demand pull-in from looming policy deadlines in California and the Northeast, in addition to the continued build-out of a robust community solar pipeline in Minnesota.

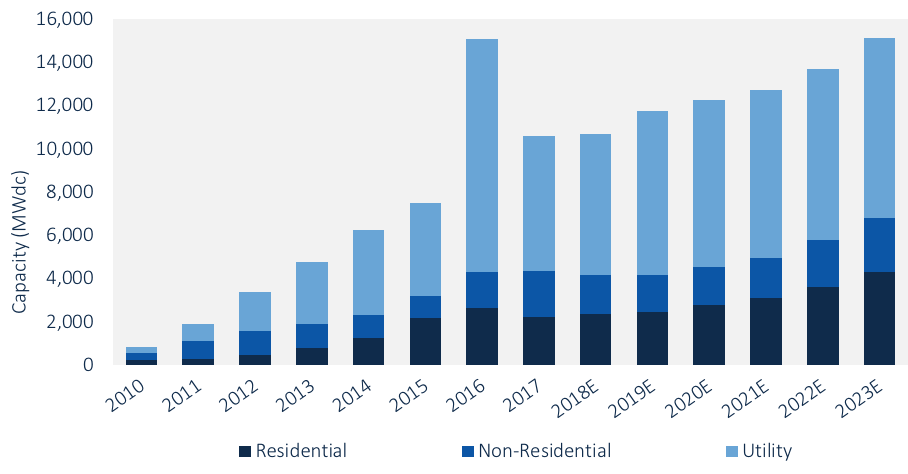

Going forward, according to SEIA and GTM Research, voluntary procurement, rather than state-mandated renewable portfolio standards, will continue to be the primary driver of new utility PV demand; it is anticipated to drive one-third of utility build-out in 2018.

GTM Research forecasts another 10.6 GW of new PV installations in 2018. In response to the impact of Section 201 and corporate tax reform, GTM Research has reduced its total U.S. solar PV forecasts by 13% from 2018E-2022E since the last edition of this report. Still, total installed U.S. PV capacity is expected to more than double over the next five years, and by 2023, more than 15 GW of PV capacity will be installed annually.

The full report can be found here.